okama.AssetList.skewness_rolling

- AssetList.skewness_rolling(window=60)

Compute rolling skewness of the return time series for each asset.

Skewness is a measure of the asymmetry of the probability distribution of a real-valued random variable about its mean. The skewness value can be positive, zero, negative, or undefined.

For normally distributed returns, the skewness should be about zero. A skewness value greater than zero means that there is more weight in the right tail of the distribution.

- Parameters:

- windowint, default 60

Rolling window size in months. This is the number of observations used for calculating the statistic. The window size should be at least 12 months.

- Returns:

- DataFrame

Rolling skewness time series for each asset.

See also

skewnessCompute skewness.

kurtosisCalculate expanding Fisher (normalized) kurtosis.

kurtosis_rollingCalculate rolling Fisher (normalized) kurtosis.

jarque_beraPerform Jarque-Bera test for normality.

kstestPerform Kolmogorov-Smirnov test for different types of distributions.

Examples

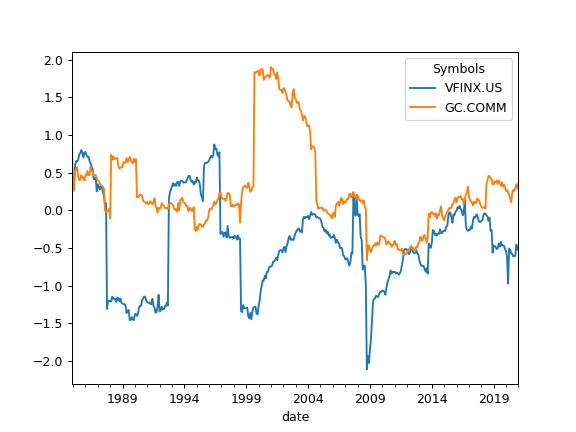

>>> import matplotlib.pyplot as plt >>> al = ok.AssetList(['VFINX.US', 'GC.COMM'], last_date='2021-01') >>> al.names {'VFINX.US': 'VANGUARD 500 INDEX FUND INVESTOR SHARES', 'GC.COMM': 'Gold'} >>> al.skewness_rolling(window=12*5).plot() >>> plt.show()