okama.AssetList.kurtosis_rolling

- AssetList.kurtosis_rolling(window=60)

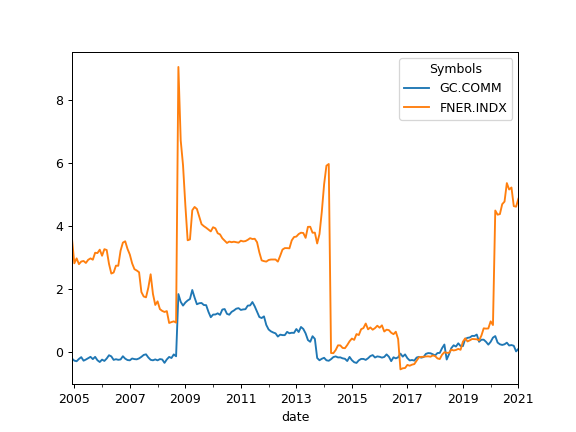

Calculate rolling Fisher (normalized) kurtosis of the return time series for each asset.

Kurtosis is the fourth central moment divided by the square of the variance. It is a measure of the “tailedness” of the probability distribution of a real-valued random variable.

Kurtosis should be close to zero for normal distribution.

- Parameters:

- windowint, default 60

Rolling window size in months. This is the number of observations used for calculating the statistic. The window size should be at least 12 months.

- Returns:

- DataFrame

Rolling kurtosis time series for each asset.

See also

skewnessCompute skewness.

skewness_rollingCompute rolling skewness.

kurtosisCalculate expanding Fisher (normalized) kurtosis.

jarque_beraPerform Jarque-Bera test for normality.

kstestPerform Kolmogorov-Smirnov test for different types of distributions.

Examples

>>> import matplotlib.pyplot as plt >>> al = ok.AssetList(['GC.COMM', 'FNER.INDX'], first_date='2000-01', last_date='2021-01') >>> al.names {'GC.COMM': 'Gold', 'FNER.INDX': 'FTSE NAREIT All Equity REITs'} >>> al.kurtosis_rolling(window=12*5).plot() >>> plt.show()