Okama Documentation

okama is a library with investment portfolio analyzing & optimization tools. CFA recommendations are used in quantitative finance.

okama goes with free «end of day» historical stock markets data and macroeconomic indicators through API.

…entities should not be multiplied without necessity

– William of Ockham (c. 1287–1347)

Okama main features

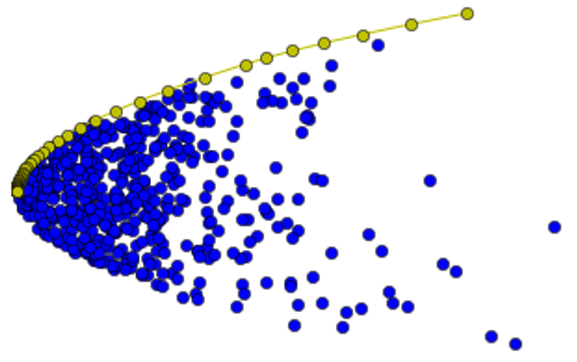

Investment portfolio constrained Markowitz Mean-Variance Analysis (MVA) and optimization

Rebalanced portfolio optimization with constraints (multi-period Efficient Frontier)

Monte Carlo Simulations for financial assets and investment portfolios

Popular risk metrics: VAR, CVaR, semi-deviation, variance and drawdowns

Forecasting models according to normal and lognormal distribution

Testing distribution on historical data

Dividend yield and other dividend indicators for stocks

Backtesting and comparing historical performance of broad range of assets and indexes in multiple currencies

Methods to track the performance of index funds (ETF) and compare them with benchmarks

Main macroeconomic indicators: inflation, central banks rates, financial ratios

Matplotlib visualization scripts for the Efficient Frontier, Transition map and assets risk / return performance

Financial data and macroeconomic indicators

okama can be used with free financial data available through API.

End of day historical data

Stocks and ETF for main world markets

Mutual funds

Commodities

Currencies

Stock indexes

Macroeconomic indicators

For several countries (USA, United Kingdom, European Union, Russia, Israel etc.):

Inflation

Central bank rates

CAPE10 (Shiller P/E) Cyclically adjusted price-to-earnings ratios

Other historical data

Real estate prices

Top bank rates

Installation

Okama can be installed from PyPI:

pip install okama

The latest development version can be installed directly from GitHub:

pip install git+https://github.com/mbk-dev/okama@dev

Warning

The development version of okama can have technical and financial issues. Please use carefully at your own risk.

Quick Start

Index Funds Performance

Main classes

Assets & Portfolio

|

A financial asset, that could be used in a list of assets or in portfolio. |

|

The list of financial assets implementation. |

|

Implementation of investment portfolio. |

|

Class to access discounted cash flow (DCF) methods of Portfolio. |

Efficient Frontier

|

Efficient Frontier with classic Mean-Variance optimization. |

|

Efficient Frontier with multi-period optimization. |

Macroeconomics

|

Inflation related data and methods. |

|

Rates of central banks and banks. |

|

Macroeconomic indicators and ratios. |