okama.AssetList.get_rolling_cumulative_return

- AssetList.get_rolling_cumulative_return(window=12, real=False)

Calculate rolling cumulative return for each asset.

The cumulative return is the total change in the asset price.

- Parameters:

- windowint, default 12

Size of the moving window in months.

- real: bool, default False

Cumulative return is adjusted for inflation (real cumulative return) if True. AssetList should be initiated with Inflation=True for real cumulative return.

- Returns:

- DataFrame

Time series of rolling cumulative return.

See also

get_rolling_cagrCalculate rolling CAGR.

get_cagrCalculate CAGR.

get_cumulative_returnCalculate cumulative return.

annual_returnCalculate annualized mean return (arithmetic mean).

Examples

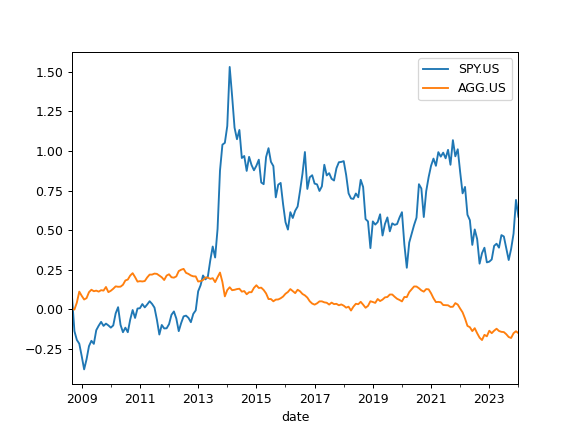

>>> import matplotlib.pyplot as plt >>> x = ok.AssetList(['SPY.US', 'AGG.US'], ccy='USD', inflation=True) >>> x.get_rolling_cumulative_return(window=5*12).plot() >>> plt.show()

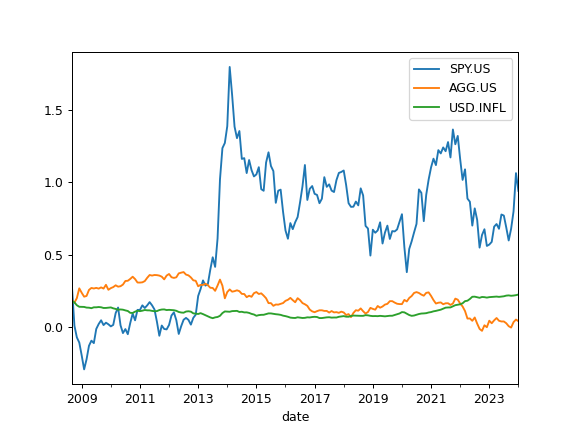

For inflation adjusted rolling cumulative return add ‘real=True’ option:

>>> x.get_rolling_cumulative_return(window=5*12, real=True).plot() >>> plt.show()