okama.Portfolio

- class Portfolio(assets=None, *, first_date=None, last_date=None, ccy='USD', inflation=True, weights=None, rebalancing_period='month', initial_amount=1000.0, cashflow=0, discount_rate=None, symbol=None)

Bases:

ListMakerImplementation of investment portfolio.

Investments portfolio is a type of financial asset (same as stocks, ETF, mutual funds, currencies etc.). Arguments are similar to AssetList, however Portfolio additionally has:

weights

rebalancing_period

initial_amount

cashflow

discount_rate

symbol

Portfolio is defined by the investment strategy, which includes: - asset allocation (financial assets and their proportions in the portfolio) - the initial investment (initial_amount parameter) - cash flows or withdrawals/contributions (cashflow parameter) - discount rate (discount_rate parameter) - the rebalancing strategy (rebalancing_period parameter)

The rebalancing is the action of bringing the portfolio that has deviated away from original target asset allocation back into line. After rebalancing the portfolio assets have original weights.

- Parameters:

- assetslist, default None

List of assets. Could include tickers or asset like objects (Asset, Portfolio). If None a single asset list with a default ticker is used.

- first_datestr, default None

First date of monthly return time series. If None the first date is calculated automatically as the oldest available date for the listed assets.

- last_datestr, default None

Last date of monthly return time series. If None the last date is calculated automatically as the newest available date for the listed assets.

- ccystr, default ‘USD’

Base currency for the list of assets. All risk metrics and returns are adjusted to the base currency.

- inflation: bool, default True

Defines whether to take inflation data into account in the calculations. Including inflation could limit available data (last_date, first_date) as the inflation data is usually published with a one-month delay. With inflation = False some properties like real return are not available.

- weightslist of float, default None

List of assets weights. The weight of an asset is the percent of an investment portfolio that corresponds to the asset. If weights = None an equally weighted portfolio is created (all weights are equal).

- rebalancing_period{‘none’, ‘month’, ‘quarter’, ‘half-year’, ‘year’}, default ‘month’

Rebalancing period (rebalancing frequency) is predetermined time intervals when the investor rebalances the portfolio. If ‘none’ assets weights are not rebalanced.

- initial_amountfloat, default 1000

Portfolio initial investment FV (at last_date).

- cashflowfloat, default 0

Portfolio monthly cash flow FV (at last_date). Negative value corresponds to withdrawals. Positive value corresponds to contributions. Cash flow value is indexed each month by inflation.

- discount_ratefloat or None, default None

Cash flow discount rate required to calculate PV values. If not provided geometric mean of inflation is taken. For portfolios without inflation the default value from settings is used.

- symbolstr, default None

Text symbol of portfolio. It is similar to tickers but have a namespace information. Portfolio symbol must end with .PF (all_weather_portfolio.PF). If None a random symbol is generated (portfolio_7802.PF).

Methods & Attributes

Calculate annual rate of return time series for portfolio.

Show assets monthly close time series adjusted to the base currency.

Calculate last twelve months (LTM) dividend yield time series (monthly) for each asset.

Portfolio size monthly time series.

Return the base currency of the Asset List.

describe([years])Generate descriptive statistics for the portfolio.

Return portfolio cash flow discount rate.

Calculate Diversification Ratio for the portfolio.

Calculate last twelve months (LTM) dividend yield time series for the portfolio.

Calculate last twelve months (LTM) dividend yield annual time series.

Calculate portfolio dividends monthly time series.

Return calendar year dividends sum time series for each asset.

Calculate drawdowns time series for the portfolio.

get_cagr([period, real])Calculate portfolio Compound Annual Growth Rate (CAGR) for a given trailing period.

get_cumulative_return([period, real])Calculate cumulative return over a given trailing period for the portfolio.

get_cvar_historic([time_frame, level])Calculate historic Conditional Value at Risk (CVAR, expected shortfall) for the portfolio.

get_rolling_cagr([window, real])Calculate rolling CAGR (Compound Annual Growth Rate) for the portfolio.

get_rolling_cumulative_return([window, real])Calculate rolling cumulative return.

get_sharpe_ratio([rf_return])Calculate Sharpe ratio.

get_sortino_ratio([t_return])Calculate Sortino ratio for the portfolio with specified target return.

get_var_historic([time_frame, level])Calculate historic Value at Risk (VaR) for the portfolio.

Perform Jarque-Bera test for normality of portfolio returns time series.

kstest([distr])Perform one sample Kolmogorov-Smirnov test on portfolio returns and evaluate goodness of fit for a given distribution.

Calculate expanding Fisher (normalized) kurtosis time series for portfolio rate of return.

kurtosis_rolling([window])Calculate rolling Fisher (normalized) kurtosis time series for portfolio rate of return.

Calculate annualized mean return (arithmetic mean) for the portfolio rate of return time series.

Calculate monthly mean return (arithmetic mean) for the portfolio rate of return time series.

monte_carlo_returns_ts([distr, years, n])Generate portfolio monthly rate of return time series with Monte Carlo simulation.

Return text name of portfolio.

Calculate the number of securities monthly time series for the portfolio assets.

percentile_distribution_cagr([distr, years, ...])Calculate percentiles for a given CAGR distribution.

percentile_history_cagr(years[, percentiles])Calculate given percentiles for portfolio rolling CAGR distribution from the historical data.

percentile_inverse_cagr([distr, years, score, n])Compute the percentile rank of a score (CAGR value).

percentile_wealth([distr, years, ...])Calculate percentiles for portfolio wealth indexes distribution.

percentile_wealth_history([years, percentiles])Calculate portfolio wealth index percentiles.

plot_assets([kind, tickers, pct_values, xy_text])Plot the assets points on the risk-return chart with annotations.

plot_forecast([distr, years, percentiles, ...])Plot forecasted ranges of wealth indexes (lines) for a given set of percentiles.

plot_forecast_monte_carlo([distr, years, n, ...])Plot Monte Carlo simulation for portfolio wealth indexes together with historical wealth index.

plot_hist_fit([distr, bins])Plot historical distribution histogram for ptrtfolio monthly rate of return time series and theoretical PDF (Probability Distribution Function).

plot_percentiles_fit([distr, figsize])Generate a quantile-quantile (Q-Q) plot of portfolio monthly rate of return against quantiles of a given theoretical distribution.

Calculate annualized real mean return (arithmetic mean) for the rate of return time series.

Return rebalancing period of the portfolio.

Get recovery period time series for the portfolio value.

Calculate annualized risk expanding time series for portfolio.

Calculate monthly risk expanding time series for Portfolio.

Calculate monthly rate of return time series for portfolio.

Return semideviation annualized value for portfolio rate of return time series.

Calculate semi-deviation monthly value for portfolio rate of return time series.

Compute expanding skewness time series for portfolio rate of return.

skewness_rolling([window])Compute rolling skewness of the return time series.

Return a text symbol of portfolio.

Return a list of financial symbols used to set the AssetList.

Return table with security name, ticker, weight for assets in the portfolio.

Return a list of tickers (symbols without a namespace) used to set the AssetList.

Calculate wealth index time series for the portfolio and accumulated inflation.

Calculate wealth index time series for the portfolio, all assets and accumulated inflation.

Get or set assets weights in portfolio.

Calculate assets weights time series.

- property weights

Get or set assets weights in portfolio.

If not defined equal weights are used for each asset.

Weights must be a list (or tuple) of float values.

- Returns:

- Values for the weights of assets in portfolio.

Examples

>>> x = ok.Portfolio(['SPY.US', 'BND.US']) >>> x.weights [0.5, 0.5]

- property weights_ts

Calculate assets weights time series.

The weights of assets in Portfolio are not constant if rebalancing_period is different from ‘month’.

- Returns:

- DataFrame

Weights of assets time series.

Examples

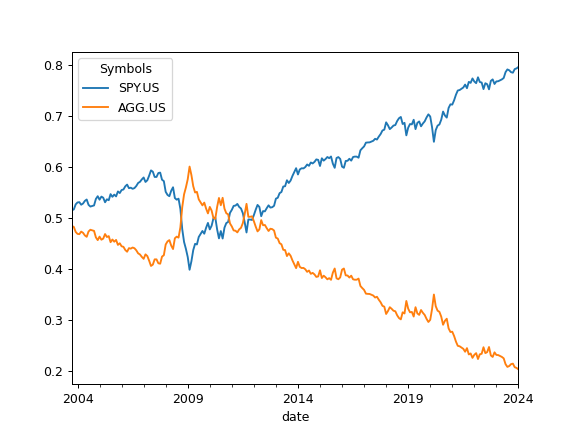

>>> import matplotlib.pyplot as plt >>> reb_period='none' # The Portfolio is not rebalanced. >>> pf = ok.Portfolio(['SPY.US', 'AGG.US'], weights=[0.5, 0.5], rebalancing_period=reb_period) >>> pf.weights_ts.plot() >>> plt.show()

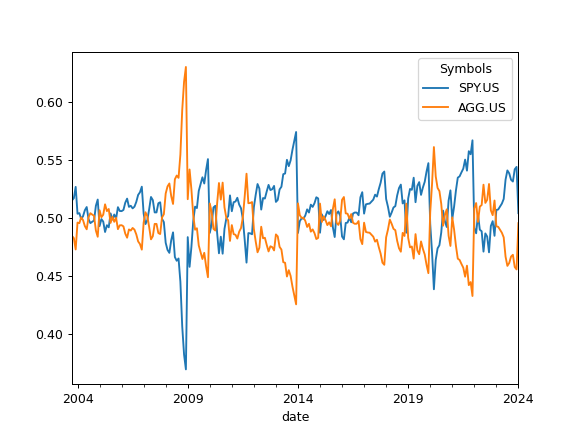

The weights of assets time series will differ significantly if the portfolio rebalancing_period is 1 year.

>>> pf.rebalancing_period = 'year' # set a new rebalancing period >>> pf.weights_ts.plot() >>> plt.show()

- property rebalancing_period

Return rebalancing period of the portfolio.

Rebalancing is the process by which an investor restores their portfolio to its target allocation by selling and buying assets. After rebalancing all the assets have original weights.

Rebalancing period (rebalancing frequency) is predetermined time intervals when the investor rebalances the portfolio.

- Returns:

- str

Portfolio rebalancing period.

- property symbol

Return a text symbol of portfolio.

Symbols are similar to tickers but have a namespace information:

SPY.US is a symbol

SPY is a ticker

Portfolios have ‘.PF’ as a namespace.

- Returns:

- str

Text symbol of the portfolio.

Examples

>>> p = ok.Portflio() >>> p.symbol # a randomly generated symbol will be shown 'portfolio_5312.PF'

>>> p.symbol = 'spy_portfolo.PF' # The symbol can be customized after initialization

New Portfolio can have a custom symbol.

>>> p = ok.Portfolio(symbol='aggressive.PF') >>> p.symbol 'aggressive.PF'

- property discount_rate

Return portfolio cash flow discount rate.

- Returns:

- float

Cash flow discount rate.

- property name

Return text name of portfolio.

For Portfolio name is equal to symbol.

- Returns:

- str

Text name of the portfolio.

>>> p = ok.Portfolio() ..

>>> p.name ..

- ‘portfolio_5312.PF’

- property ror

Calculate monthly rate of return time series for portfolio.

- Returns:

- Series

Rate of return monthly time series for portfolio.

Examples

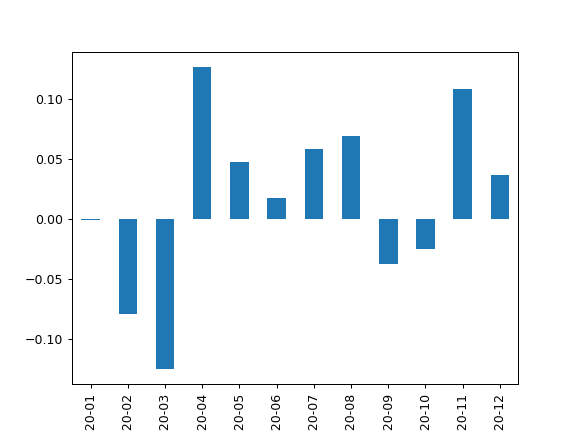

>>> pf = ok.Portfolio(first_date='2020-01', last_date='2020-12') >>> pf.ror Date 2020-01 -0.0004 2020-02 -0.0792 2020-03 -0.1249 2020-04 0.1270 2020-05 0.0476 2020-06 0.0177 2020-07 0.0589 2020-08 0.0698 2020-09 -0.0374 2020-10 -0.0249 2020-11 0.1088 2020-12 0.0370 Freq: M, Name: portfolio_4669.PF, dtype: float64

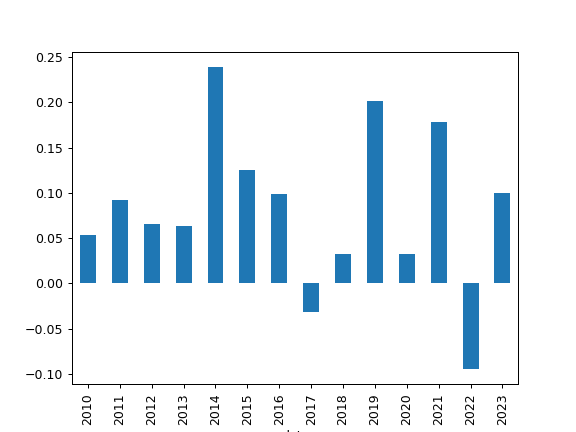

>>> import matplotlib.pyplot as plt >>> pf.ror.plot(kind='bar') >>> plt.show()

- property wealth_index

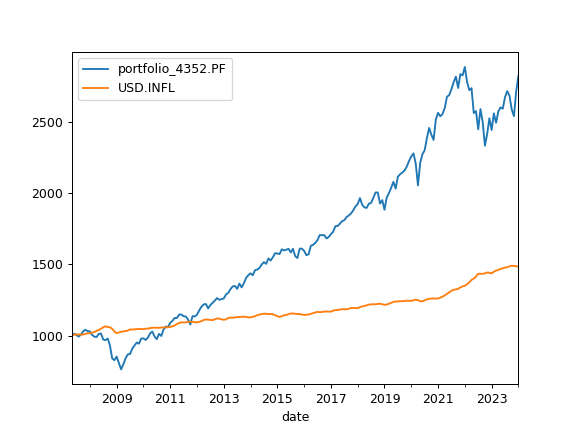

Calculate wealth index time series for the portfolio and accumulated inflation.

Wealth index (Cumulative Wealth Index) is a time series that presents the value of portfolio over historical time period. Accumulated inflation time series is added if inflation=True in the Portfolio.

Wealth index is obtained from the accumulated return multiplicated by the initial investments. That is: 1000 * (Acc_Return + 1) Initial investments are taken as 1000 units of the Portfolio base currency.

- Returns:

- Time series of wealth index values for portfolio and accumulated inflation.

Examples

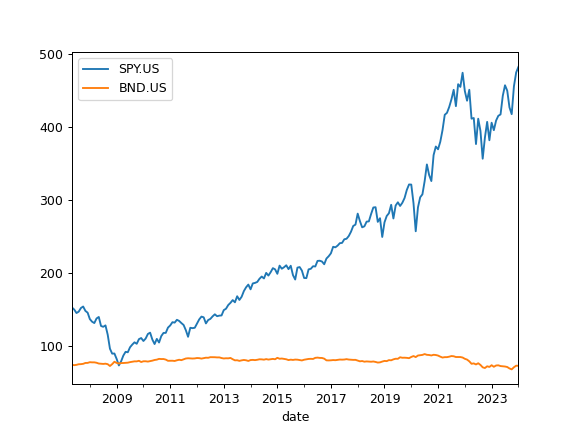

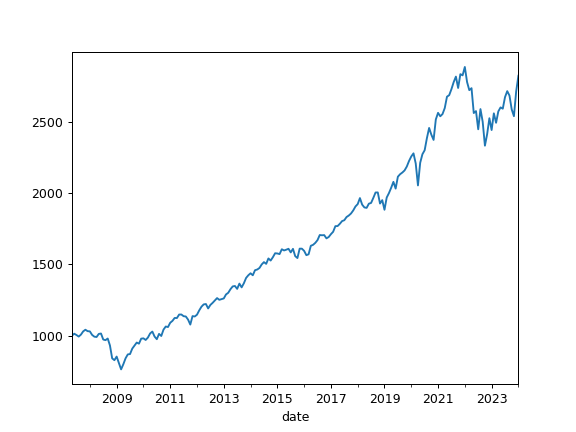

>>> import matplotlib.pyplot as plt >>> x = ok.Portfolio(['SPY.US', 'BND.US']) >>> x.wealth_index.plot() >>> plt.show()

- property wealth_index_with_assets

Calculate wealth index time series for the portfolio, all assets and accumulated inflation. Сash flows are not taken into account.

Wealth index (Cumulative Wealth Index) is a time series that presents the value of portfolio over historical time period. Accumulated inflation time series is added if inflation=True in the Portfolio.

Wealth index is obtained from the accumulated return multiplicated by the initial investments. initial_amount_pv * (Acc_Return + 1)

initial_amount_pv is the discounted value of the initial investments (initial_amount).

- Returns:

- DataFrame

Time series of wealth index values for portfolio, each asset and accumulated inflation.

Examples

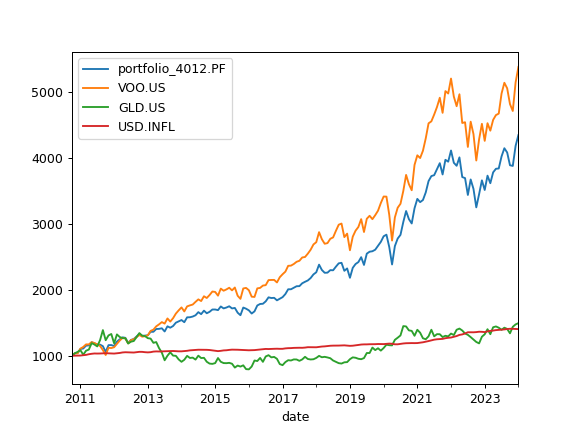

>>> import matplotlib.pyplot as plt >>> pf = ok.Portfolio(['VOO.US', 'GLD.US'], weights=[0.8, 0.2]) >>> pf.wealth_index_with_assets.plot() >>> plt.show()

- property mean_return_monthly

Calculate monthly mean return (arithmetic mean) for the portfolio rate of return time series.

Mean return calculated for the full history period.

- Returns:

- Float

Mean return value.

Examples

>>> pf = ok.Portfolio(['ISF.LSE', 'XGLE.LSE'], weights=[0.6, 0.4], ccy='GBP') >>> pf 0.0001803312727272665

- property mean_return_annual

Calculate annualized mean return (arithmetic mean) for the portfolio rate of return time series.

Mean return calculated for the full history period.

- Returns:

- Float

Mean return value.

Examples

>>> pf = ok.Portfolio(['XCS6.XETR', 'PHAU.LSE'], weights=[0.85, 0.15], ccy='USD') >>> pf.names {'XCS6.XETR': 'Xtrackers MSCI China UCITS ETF 1C', 'PHAU.LSE': 'WisdomTree Physical Gold'} >>> pf.mean_return_annual 0.09005826844072184

- property annual_return_ts

Calculate annual rate of return time series for portfolio.

Rate of return is calculated for each calendar year.

- Returns:

- DataFrame

Calendar annual rate of return time series.

Examples

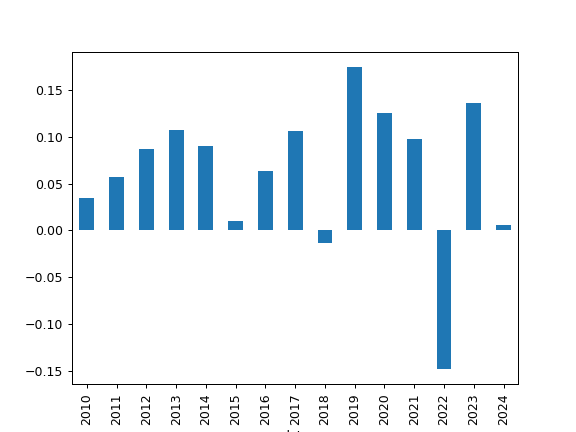

>>> import matplotlib.pyplot as plt >>> pf = ok.Portfolio(['VOO.US', 'AGG.US'], weights=[0.4, 0.6]) >>> pf.annual_return_ts.plot(kind='bar') >>> plt.show()

Plot annual returns for portfolio with EUR as the base currency.

>>> pf = ok.Portfolio(['VOO.US', 'AGG.US'], weights=[0.4, 0.6], ccy='EUR') >>> pf.annual_return_ts.plot(kind='bar') >>> plt.show()

- get_cagr(period=None, real=False)

Calculate portfolio Compound Annual Growth Rate (CAGR) for a given trailing period.

Compound annual growth rate (CAGR) is the rate of return that would be required for an investment to grow from its initial to its final value, assuming all incomes were reinvested.

Inflation adjusted annualized returns (real CAGR) are shown with real=True option.

Annual inflation value is calculated for the same period if inflation=True in the AssetList.

- Parameters:

- period: int, optional

CAGR trailing period in years. None for the full time CAGR.

- real: bool, default False

CAGR is adjusted for inflation (real CAGR) if True. Portfolio should be initiated with Inflation=True for real CAGR.

- Returns:

- Series

Portfolio CAGR value and annualized inflation (optional).

Notes

CAGR is not defined for periods less than 1 year (NaN values are returned).

Examples

>>> pf = ok.Portfolio(['XCS6.XETR', 'PHAU.LSE'], weights=[0.85, 0.15], ccy='USD') >>> pf.names {'XCS6.XETR': 'Xtrackers MSCI China UCITS ETF 1C', 'PHAU.LSE': 'WisdomTree Physical Gold'}

To get inflation adjusted return (real annualized return) add real=True option:

>>> pf.get_cagr(period=5, real=True) portfolio_5625.PF 0.121265 dtype: float64

- get_rolling_cagr(window=12, real=False)

Calculate rolling CAGR (Compound Annual Growth Rate) for the portfolio.

- Parameters:

- windowint, default 12

Size of the moving window in months. Window size should be at least 12 months for CAGR.

- real: bool, default False

CAGR is adjusted for inflation (real CAGR) if True. Portfolio should be initiated with Inflation=True for real CAGR.

- Returns:

- DataFrame

Time series of rolling CAGR and mean inflation (optionaly).

Notes

CAGR is not defined for periods less than 1 year (NaN values are returned).

Examples

>>> x = ok.Portfolio(['DXET.XFRA', 'DBXN.XFRA'], ccy='EUR', inflation=True) >>> x.get_rolling_cagr(window=5*12, real=True) portfolio_7645.PF 2013-09 0.029914 2013-10 0.052435 2013-11 0.055651 2013-12 0.045180 2014-01 0.063153 ... 2021-01 0.032734 2021-02 0.037779 2021-03 0.043811 2021-04 0.043729 2021-05 0.042704

- get_cumulative_return(period=None, real=False)

Calculate cumulative return over a given trailing period for the portfolio.

The cumulative return is the total change in the portfolio price during the investment period.

Inflation adjusted cumulative returns (real cumulative returns) are shown with real=True option. Annual inflation data is calculated for the same period if inflation=True in the AssetList.

- Parameters:

- period: str, int or None, default None

Trailing period in years. None - full time cumulative return. ‘YTD’ - (Year To Date) period of time beginning the first day of the calendar year up to the last month.

- real: bool, default False

Cumulative return is adjusted for inflation (real cumulative return) if True. Portfolio should be initiated with Inflation=True for real cumulative return.

- Returns:

- Series

Cumulative rate of return values for portfolio and cumulative inflation (if inflation=True in Portfolio).

Examples

>>> pf = ok.Portfolio(['BTC-USD.CC', 'LTC-USD.CC'], weights=[.8, .2], last_date='2021-03') >>> pf.get_cumulative_return(period=2, real=True) portfolio_6232.PF 9.39381 dtype: float64

- get_rolling_cumulative_return(window=12, real=False)

Calculate rolling cumulative return.

The cumulative return is the total change in the portfolio price.

- Parameters:

- windowint, default 12

Size of the moving window in months.

- real: bool, default False

Cumulative return is adjusted for inflation (real cumulative return) if True. Portfolio should be initiated with Inflation=True for real cumulative return.

- Returns:

- DataFrame

Time series of rolling cumulative return and inflation (optional).

Examples

>>> pf = ok.Portfolio(['SPY.US', 'AGG.US', 'GLD.US'], weights=[.6, .35, .05], rebalancing_period='year') >>> pf.get_rolling_cumulative_return(window=24, real=True) portfolio_9012.PF 2006-11 0.125728 2006-12 0.104348 2007-01 0.129601 2007-02 0.110680 2007-03 0.132610 ... 2021-03 0.263755 2021-04 0.275474 2021-05 0.322736 2021-06 0.264963 2021-07 0.273801 [177 rows x 1 columns]

- property assets_close_monthly

Show assets monthly close time series adjusted to the base currency.

- Returns:

- DataFrame

Assets monthly close time series adjusted to the base currency.

Examples

>>> import matplotlib.pyplot as plt >>> pf = ok.Portfolio(['SPY.US', 'BND.US'], ccy='USD') >>> pf.assets_close_monthly.plot() >>> plt.show()

- property close_monthly

Portfolio size monthly time series.

Portfolio size is shown in base currency units. It is similar to the close value of an asset. Initial portfolio value is equal to 1000 units of base currency.

- Returns:

- pd.Series

Monthly portfolio size time series.

Notes

‘close_mothly’ shows the same output as the ‘wealth_index’. This property is required as Portfolio must have the same attributes as an Asset.

Examples

>>> import matplotlib.pyplot as plt >>> pf = ok.Portfolio(['SPY.US', 'BND.US'], ccy='USD') >>> pf.close_monthly.plot() >>> plt.show()

- property number_of_securities

Calculate the number of securities monthly time series for the portfolio assets.

The number of securities in the Portfolio is changing over time as the dividends are reinvested. Portfolio rebalancing also affects the number of securities.

Initial number of securities depends on the portfolio size in base currency (1000 units).

- Returns:

- DataFrame

Number of securities monthly time series for the portfolio assets.

Examples

>>> pf = ok.Portfolio(['SPY.US', 'BND.US'], ccy='USD', last_date='07-2021') >>> pf.number_of_securities SPY.US BND.US Date 2007-05 3.261153 6.687174 2007-06 3.337216 6.758447 2007-07 3.407015 6.643519 2007-08 3.410268 6.663862 2007-09 3.372630 6.798730 ... ... 2021-03 3.273521 15.313911 2021-04 3.204779 15.685601 2021-05 3.196768 15.749127 2021-06 3.186124 15.879056 2021-07 3.166335 16.003569 [171 rows x 2 columns]

- property dividends

Calculate portfolio dividends monthly time series.

Portfolio dividends are obtained by summing asset dividends adjusted to the base currency. Dividends size depends on the portfolio value and number of securities.

- Returns:

- Series

Portfolio dividends monthly time series.

Examples

>>> pf = ok.Portfolio(['SPY.US', 'BND.US'], ccy='USD', last_date='07-2021') >>> pf.dividends 2007-05 0.849271 2007-06 3.928855 2007-07 1.551262 2007-08 2.023148 2007-09 4.423416 ... 2021-03 6.155337 2021-04 3.019478 2021-05 2.056836 2021-06 6.519521 2021-07 2.114071 Freq: M, Name: portfolio_2951.PF, Length: 171, dtype: float64

- property dividend_yield

Calculate last twelve months (LTM) dividend yield time series for the portfolio. Time series has monthly values.

Portfolio dividend yield is a weighted sum of the assets dividend yields (adjusted to the portfolio base currency).

For an asset LTM dividend yield is the sum trailing twelve months of common dividends per share divided by the current price per share.

- Returns:

- Series

Portfolio LTM dividend yield monthly time series.

Examples

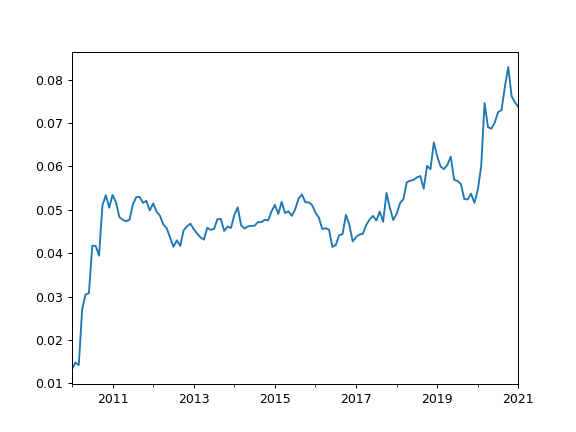

>>> pf = ok.Portfolio(['T.US', 'XOM.US'], weights=[0.8, 0.2], first_date='2010-01', last_date='2021-01', ccy='USD') >>> pf.dividend_yield 2010-01 0.013249 2010-02 0.014835 2010-03 0.014257 ... 2020-11 0.076132 2020-12 0.074743 2021-01 0.073643 Freq: M, Name: portfolio_8836.PF, Length: 133, dtype: float64

>>> import matplotlib.pyplot as plt >>> pf.dividend_yield.plot() >>> plt.show()

- property dividends_annual

Return calendar year dividends sum time series for each asset.

- Returns:

- DataFrame

Annual dividends time series for each asset.

Examples

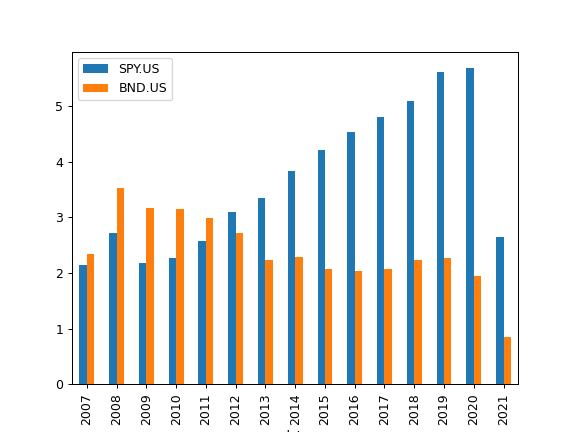

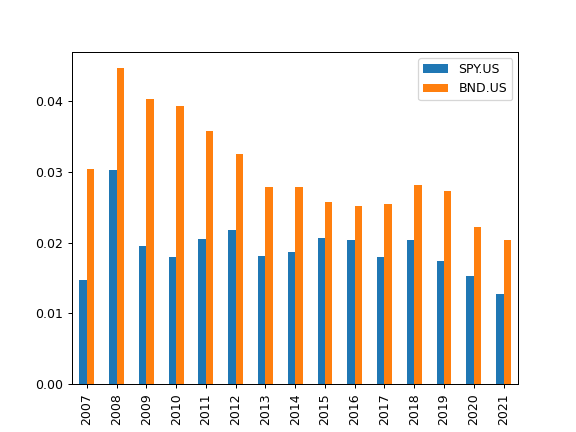

>>> import matplotlib.pyplot as plt >>> pf = ok.Portfolio(['SPY.US', 'BND.US'], ccy='USD', last_date='07-2021') >>> pf.dividends_annual.plot(kind='bar') >>> plt.show()

- property dividend_yield_annual

Calculate last twelve months (LTM) dividend yield annual time series.

Time series is based on the dividend yield for the end of calendar year.

LTM dividend yield is the sum trailing twelve months of common dividends per share divided by the current price per share.

All yields are calculated in the asset list base currency after adjusting the dividends and price time series. Forecasted (future) dividends are removed.

- Returns:

- DataFrame

Time series of LTM dividend yield for each asset.

See also

dividend_yieldDividend yield time series.

dividends_annualCalendar year dividends time series.

dividend_paying_yearsNumber of years of consecutive dividend payments.

dividend_growing_yearsNumber of years when the annual dividend was growing.

get_dividend_mean_yieldArithmetic mean for annual dividend yield.

get_dividend_mean_growth_rateGeometric mean of annual dividends growth rate.

Examples

>>> import matplotlib.pyplot as plt >>> pf = ok.Portfolio(['SPY.US', 'BND.US'], ccy='USD', last_date='07-2021') >>> pf.dividend_yield_annual.plot(kind='bar') >>> plt.show()

- property assets_dividend_yield

Calculate last twelve months (LTM) dividend yield time series (monthly) for each asset.

LTM dividend yield is the sum trailing twelve months of common dividends per share divided by the current price per share.

All yields are calculated in the asset list base currency after adjusting the dividends and price time series. Forecasted (future) dividends are removed. Zero value time series are created for assets without dividends.

- Returns:

- DataFrame

Monthly time series of LTM dividend yield for each asset.

See also

dividend_yield_annualCalendar year dividend yield time series.

dividends_annualCalendar year dividends time series.

dividend_paying_yearsNumber of years of consecutive dividend payments.

dividend_growing_yearsNumber of years when the annual dividend was growing.

get_dividend_mean_yieldArithmetic mean for annual dividend yield.

get_dividend_mean_growth_rateGeometric mean of annual dividends growth rate.

Examples

>>> x = ok.AssetList(['T.US', 'XOM.US'], first_date='1984-01', last_date='1994-12') >>> x.dividend_yield T.US XOM.US 1984-01 0.000000 0.000000 1984-02 0.000000 0.002597 1984-03 0.002038 0.002589 1984-04 0.001961 0.002346 ... ... 1994-09 0.018165 0.012522 1994-10 0.018651 0.011451 1994-11 0.018876 0.012050 1994-12 0.019344 0.011975 [132 rows x 2 columns]

- property real_mean_return

Calculate annualized real mean return (arithmetic mean) for the rate of return time series.

Real rate of return is adjusted for inflation. Real return is defined if there is an inflation=True option in Portfolio.

- Returns:

- float

Annualized value of the mean for the real rate of return time series.

Examples

>>> pf = ok.Portfolio(['MSFT.US', 'AAPL.US']) >>> pf.real_mean_return 0.3088967455111862

- property risk_monthly

Calculate monthly risk expanding time series for Portfolio.

Monthly risk of portfolio is a standard deviation of the rate of return time series. Standard deviation (sigma σ) is normalized by N-1.

- Returns:

- Series

Standard deviation of the monthly return expanding time series.

See also

risk_annualCalculate annualized risks.

semideviation_monthlyCalculate semideviation monthly values.

semideviation_annualCalculate semideviation annualized values.

get_var_historicCalculate historic Value at Risk (VaR).

get_cvar_historicCalculate historic Conditional Value at Risk (CVaR).

drawdownsCalculate drawdowns.

Examples

>>> pf = ok.Portfolio(['MSFT.US', 'AAPL.US']) >>> pf.risk_monthly date 1986-05 0.020117 1986-06 0.122032 1986-07 0.130113 1986-08 0.116642 ... 2023-08 0.092875 2023-09 0.092861 2023-10 0.092759 2023-11 0.092763 2023-12 0.092665 Freq: M, Name: portfolio_1094.PF, Length: 453, dtype: float64

- property risk_annual

Calculate annualized risk expanding time series for portfolio.

Risk is a standard deviation of the rate of return.

Annualized risk is calculated for rate of retirun time series for the sample from ‘first_date’ to ‘last_date’.

- Returns:

- Series

Annualized standard deviation of the monthly return expanding time series.

Examples

>>> pf = ok.Portfolio(['MSFT.US', 'AAPL.US']) >>> pf.risk_annual date 1986-05 0.285175 1986-06 0.890909 1986-07 0.616876 1986-08 0.632270 1986-09 0.509642 ... 2023-08 0.428297 2023-09 0.427350 2023-10 0.426961 2023-11 0.427930

- property semideviation_monthly

Calculate semi-deviation monthly value for portfolio rate of return time series.

Semi-deviation (Downside risk) is the risk of the return being below the expected return.

- Returns:

- float

Semi-deviation monthly value for portfolio rate of return time series.

Examples

>>> pf = ok.Portfolio(['MSFT.US', 'AAPL.US']) >>> pf.semideviation_monthly 0.05601433676604449

- property semideviation_annual

Return semideviation annualized value for portfolio rate of return time series.

Semi-deviation (Downside risk) is the risk of the return being below the expected return.

- Returns:

- float

Annualized semi-deviation monthly value for portfolio rate of return time series.

Examples

>>> pf = ok.Portfolio(['MSFT.US', 'AAPL.US']) >>> pf.semideviation_annual 0.1940393544621248

- get_var_historic(time_frame=12, level=1)

Calculate historic Value at Risk (VaR) for the portfolio.

The VaR calculates the potential loss of an investment with a given time frame and confidence level. Loss is a positive number (expressed in cumulative return). If VaR is negative there are expected gains at this confidence level.

- Parameters:

- time_frameint, default 12

Time frame for VAR. Default is 12 months.

- levelint, default 1

Confidence level in percents. Default value is 1%.

- Returns:

- Float

Historic Value at Risk (VaR) value for the portfolio.

Examples

>>> x = ok.Portfolio(['SP500TR.INDX', 'SP500BDT.INDX'], last_date='2021-01') >>> x.get_var_historic(time_frame=12, level=1) 0.24030006476701732

- get_cvar_historic(time_frame=12, level=1)

Calculate historic Conditional Value at Risk (CVAR, expected shortfall) for the portfolio.

CVaR is the average loss over a specified time period of unlikely scenarios beyond the confidence level. Loss is a positive number (expressed in cumulative return). If CVaR is negative there are expected gains at this confidence level.

- Parameters:

- time_frameint, default 12 (12 months)

Time period size in months

- levelint, default 1

Confidence level in percents to calculate the VaR. Default value is 1% (1% quantile).

- Returns:

- Float

Historic Conditional Value at Risk (CVAR, expected shortfall) value for the portfolio.

Examples

>>> x = ok.Portfolio(['USDEUR.FX', 'BTC-USD.CC'], last_date='2021-01') >>> x.get_cvar_historic(time_frame=2, level=1) 0.3566909250442616

- property drawdowns

Calculate drawdowns time series for the portfolio.

The drawdown is the percent decline from a previous peak in wealth index.

- Returns:

- Series

Drawdowns time series for the portfolio

- property recovery_period

Get recovery period time series for the portfolio value.

The recovery period (drawdown duration) is the number of months to reach the value of the last maximum.

- Returns:

- pd.Series

Recovery period time series for the portfolio value

See also

drawdownsCalculate drawdowns time series.

Notes

The largest recovery period does not necessary correspond to the max drawdown.

Examples

>>> pf = ok.Portfolio(['SPY.US', 'AGG.US'], weights=[0.5, 0.5]) >>> pf.recovery_period.nlargest() date 2010-10 35 2004-10 7 2012-01 7 2019-03 6 2018-07 5 Freq: M, Name: portfolio_5724.PF, dtype: int32

- describe(years=(1, 5, 10))

Generate descriptive statistics for the portfolio.

Statistics includes:

YTD (Year To date) compound return

CAGR for a given list of periods and full available period

Annualized mean rate of return (full available period)

LTM Dividend yield - last twelve months dividend yield

Risk metrics (full available period):

risk (standard deviation)

CVAR (timeframe is 1 year)

max drawdowns (and dates)

- Parameters:

- yearstuple of (int,), default (1, 5, 10)

List of periods for CAGR statistics.

- Returns:

- DataFrame

Table of descriptive statistics for the portfolio.

See also

get_cumulative_returnCalculate cumulative return.

get_cagrCalculate assets Compound Annual Growth Rate (CAGR).

dividend_yieldCalculate dividend yield (LTM).

risk_annualReturn annualized risks (standard deviation).

get_cvarCalculate historic Conditional Value at Risk (CVAR, expected shortfall).

drawdownsCalculate drawdowns.

Examples

>>> pf = ok.Portfolio(['SPY.US', 'BND.US'], ccy='USD', last_date='07-2021') >>> pf.describe(years=[2, 5, 7]) # 'years' customizes the timeframe for the CAGR property period portfolio_2951.PF inflation 0 compound return YTD 0.084098 0.048154 1 CAGR 2 years 0.141465 0.031566 2 CAGR 5 years 0.102494 0.025582 3 CAGR 7 years 0.091694 0.019656 4 CAGR 14 years, 3 months 0.074305 0.019724 5 Dividend yield LTM 0.016504 NaN 6 Risk 14 years, 3 months 0.086103 NaN 7 CVAR 14 years, 3 months 0.214207 NaN 8 Max drawdown 14 years, 3 months -0.266915 NaN 9 Max drawdown date 14 years, 3 months 2009-02 NaN

- property table

Return table with security name, ticker, weight for assets in the portfolio.

- Returns:

- DataFrame

Security name - ticker - weight table.

Examples

>>> pf = ok.Portfolio(["MSFT.US", "AAPL.US"]) >>> pf.table asset name ticker weights 0 Microsoft Corporation MSFT.US 0.5 1 Apple Inc AAPL.US 0.5

- percentile_inverse_cagr(distr='norm', years=1, score=0, n=None)

Compute the percentile rank of a score (CAGR value).

Percentile rank can be calculated for given distribution type or for hsitorical distribution of CAGR.

If percentile_inverse of, for example, 0% (CAGR value) is equal to 8% for 1 year time frame it means that 8% of the CAGR values in the distribution are negative in 1 year periods. Or in other words the probability of getting negative result after 1 year of investments is 8%.

- Parameters:

- distr: {‘norm’, ‘lognorm’, ‘hist’}, default ‘norm’

The rate of teturn distribution type. ‘norm’ - for normal distribution. ‘lognorm’ - for lognormal distribution. ‘hist’ - percentiles are taken from the historical data.

- years: int, default 1

Period length (time frame) in years when CAGR is calculated.

- score: float, default 0

Score that is compared to the elements in CAGR array.

- n: int, optional

Number of random time series with the defined distributions (for ‘norm’ or ‘lognorm’ only). Larger argument values can be used to increase the precision of the calculation. But this will lead to slower performance. Is not required for historical distribution (dist=’hist’). For ‘norm’ or ‘lognorm’ distribution default value n=1000 is used.

- Returns:

- float

Percentile-position of score (0-100) relative to distribution.

Examples

>>> pf = ok.Portfolio(['SPY.US', 'AGG.US', 'GLD.US'], weights=[.60, .35, .05], rebalancing_period='year') >>> pf.percentile_inverse_cagr(distr='lognorm', score=0, years=1, n=5000) 18.08 The probability of getting negative result (score=0) in 1 year period for lognormal distribution.

- percentile_history_cagr(years, percentiles=[10, 50, 90])

Calculate given percentiles for portfolio rolling CAGR distribution from the historical data.

CAGR - Compound Annual Growth Rate. Each percentile is calculated for a period range from 1 year to ‘years’.

- Parameters:

- years: int, default 1

Max window size for rolling CAGR in the distribution in years. It should not exceed 1/2 of the portfolio history period length ‘period_length’.

- percentiles: list of int, default [10, 50, 90]

List of percentiles to be calculated.

- Returns:

- DataFrame

Table with percentiles values for each period from 1 to ‘years’.

Examples

>>> pf = ok.Portfolio(['SPY.US', 'AGG.US', 'GLD.US'], weights=[.60, .35, .05], rebalancing_period='none') >>> pf.percentile_history_cagr(years=5, percentiles=[1, 50, 99]) 1 50 99 years 1 -0.231327 0.098693 0.295343 2 -0.101689 0.091824 0.206471 3 -0.036771 0.085428 0.157833 4 -0.007674 0.085178 0.142195 5 0.030933 0.082865 0.134496

- percentile_wealth_history(years=1, percentiles=[10, 50, 90])

Calculate portfolio wealth index percentiles.

Percentiles are derived from rolling CAGR historical distribution. CAGR - Compound Annual Growth Rate. Wealth index (Cumulative Wealth Index) is a time series that presents the value of portfolio over a given time period.

Actual portfolio wealth is adjusted to the last known historical value (from ‘wealth_index’). It is useful for a chart with historical wealth index and forecasted values.

- Parameters:

- years: int, default 1

Time frame for portfolio wealth index percentiles. It should not exceed 1/2 of the portfolio history period length ‘period_length’. Percentiles are calculated for periods from 1 to ‘years’.

- percentiles: list of int, default [10, 50, 90]

List of percentiles to be calculated.

- Returns:

- DataFrame

Table with portfolio wealth index percentiles for each period from 1 to ‘years’.

Examples

>>> pf = ok.Portfolio(['SPY.US', 'AGG.US', 'GLD.US'], weights=[.60, .35, .05], rebalancing_period='month') >>> pf.percentile_wealth_history(years=5) 10 50 90 years 1 3815.660408 4202.758919 4457.210561 2 3727.946026 4540.888480 5005.291952 3 3797.214674 4855.631902 5384.216628 4 4173.503054 5274.584657 6018.571025 5 4613.287195 5706.343210 6694.576137

- monte_carlo_returns_ts(distr='norm', years=1, n=100)

Generate portfolio monthly rate of return time series with Monte Carlo simulation.

Monte Carlo simulation generates n random monthly time series with a given distribution. Forecast period should not exceed 1/2 of portfolio history period length.

First date of forecaseted returns is portfolio last_date.

- Parameters:

- distr{‘norm’, ‘lognorm’}, default ‘norm’

Distribution type for rate of return time series. ‘norm’ - for normal distribution. ‘lognorm’ - for lognormal distribution.

- yearsint, default 1

Forecast period for portfolio monthly rate of return time series. It should not exceed 1/2 of the portfolio history period length ‘period_length’.

- nint, default 100

Number of random rate of return time series to generate with Monte Carlo simulation.

- Returns:

- DataFrame

Table with n random rate of return monthly time series.

Examples

>>> pf = ok.Portfolio(['SPY.US', 'AGG.US', 'GLD.US'], weights=[.60, .35, .05], rebalancing_period='month') >>> pf.monte_carlo_returns_ts(years=8, distr='norm', n=5000) 0 1 2 ... 4997 4998 4999 2021-07 -0.008383 -0.013167 -0.031659 ... 0.046717 0.065675 0.017933 2021-08 0.038773 -0.023627 0.039208 ... -0.016075 0.034439 0.001856 2021-09 0.005026 -0.007195 -0.003300 ... -0.041591 0.021173 0.114225 2021-10 -0.007257 0.003013 -0.004958 ... 0.037057 -0.009689 -0.003242 2021-11 -0.005006 0.007090 0.020741 ... 0.026509 -0.023554 0.010271 ... ... ... ... ... ... ... 2029-02 -0.065898 -0.003673 0.001198 ... 0.039293 0.015963 -0.050704 2029-03 0.021215 0.008783 -0.017003 ... 0.035144 0.002169 0.015055 2029-04 0.002454 -0.016281 0.017004 ... 0.032535 0.027196 -0.029475 2029-05 0.011206 0.023396 -0.013757 ... -0.044717 -0.025613 -0.002066 2029-06 -0.016740 -0.007955 0.002862 ... -0.027956 -0.012339 0.048974 [96 rows x 5000 columns]

- percentile_distribution_cagr(distr='norm', years=1, percentiles=[10, 50, 90], n=10000)

Calculate percentiles for a given CAGR distribution.

CAGR - Compound Annual Growth Rate. CAGR is calculated for each of n random returns time series of a given distribution. Random time series are generated with Monte Carlo simulation. CAGR time frame should not exceed 1/2 of portfolio history period length.

- Parameters:

- distr{‘norm’, ‘lognorm’}, default ‘norm’

Distribution type for the rate of return of portfolio. ‘norm’ - for normal distribution. ‘lognorm’ - for lognormal distribution.

- years: int, default 1

Time frame for portfolio CAGR. It should not exceed 1/2 of the portfolio history period length ‘period_length’.

- percentiles: list of int, default [10, 50, 90]

List of percentiles to be calculated.

- nint, default 10000

Number of random time series to generate with Monte Carlo simulation. Larger argument values can be used to increase the precision of the calculation. But this will lead to slower performance.

- Returns:

- dict

Dictionary {Percentile: value}

Examples

>>> pf = ok.Portfolio(['SPY.US', 'AGG.US', 'GLD.US'], weights=[.60, .35, .05], rebalancing_period='year') >>> pf.percentile_distribution_cagr() {10: -0.0329600265453808, 50: 0.08247141141668779, 90: 0.21338327078214836} Forecast CAGR according to normal distribution within 1 year period. >>> pf.percentile_distribution_cagr(years=5) {10: 0.030625112922274055, 50: 0.08346815557550402, 90: 0.13902575176654647} Forecast CAGR according to normal distribution within 5 year period.

- percentile_wealth(distr='norm', years=1, percentiles=[10, 50, 90], today_value=None, n=1000)

Calculate percentiles for portfolio wealth indexes distribution.

Portfolio wealth indexes are derived from the rate of return time series of a given distribution type.

- Parameters:

- distr{‘hist’, ‘norm’, ‘lognorm’}, default ‘norm’

Distribution type for the rate of return of portfolio. ‘norm’ - for normal distribution. ‘lognorm’ - for lognormal distribution. ‘hist’ - percentiles are taken from the historical data.

- yearsint, default 1

Investment period length to calculate wealth index. It should not exceed 1/2 of the portfolio history period length ‘period_length’.

- percentileslist of int, default [10, 50, 90]

List of percentiles to be calculated.

- today_valueint, optional

Initial value of the wealth index. If today_value is None the last value of the historical wealth indexes is taken. It can be useful to plot the forecast of wealth index togeather with the hitorical data.

- nint, default 1000

Number of random time series to generate with Monte Carlo simulation (for ‘norm’ or ‘lognorm’ only). Larger argument values can be used to increase the precision of the calculation. But this will lead to slower performance. Is not required for historical distribution (dist=’hist’).

- Returns:

- dict

Dictionary {Percentile: value}

Examples

>>> pf = ok.Portfolio(['SPY.US', 'AGG.US', 'GLD.US'], weights=[.60, .35, .05], rebalancing_period='year') >>> pf.percentile_wealth(distr='hist', years=5, today_value=1000, n=5000) {10: 1228.3741255659957, 50: 1491.7857161011104, 90: 1745.1130920663286} Percentiles values for the wealth index 5 years forecast if the initial value is 1000.

- property skewness

Compute expanding skewness time series for portfolio rate of return.

For normally distributed data, the skewness should be about zero. A skewness value greater than zero means that there is more weight in the right tail of the distribution.

- Returns:

- Series

Expanding skewness time series

Examples

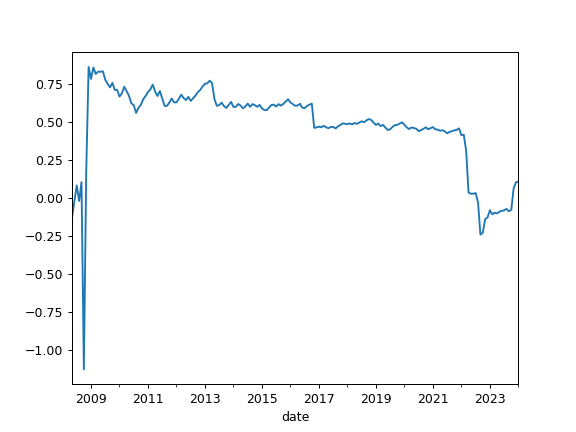

>>> pf = ok.Portfolio(['BND.US']) >>> pf.skewness Date 2008-05 -0.134193 2008-06 -0.022349 2008-07 0.081412 2008-08 -0.020978 ... 2021-04 0.441430 2021-05 0.445772 2021-06 0.437383 2021-07 0.425247 Freq: M, Name: portfolio_8378.PF, Length: 159, dtype: float64

>>> import matplotlib.pyplot as plt >>> pf.skewness.plot() >>> plt.show()

- skewness_rolling(window=60)

Compute rolling skewness of the return time series.

For normally distributed rate of return, the skewness should be about zero. A skewness value greater than zero means that there is more weight in the right tail of the distribution.

- Parameters:

- windowint, default 60

Size of the moving window in months. The window size should be at least 12 months.

- Returns:

- Series

Expanding skewness time series

Examples

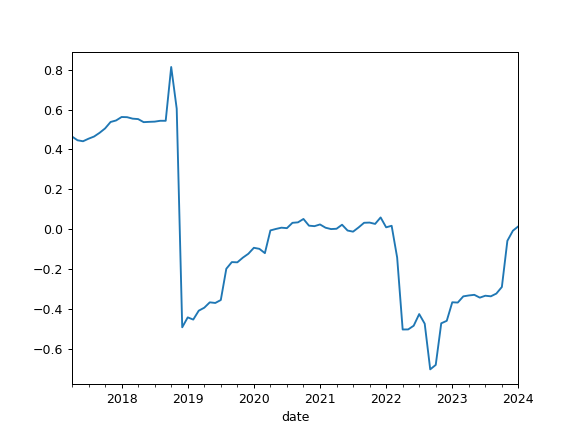

>>> pf = ok.Portfolio(['BND.US']) >>> pf.skewness_rolling(window=12*10) Date 2017-04 0.464916 2017-05 0.446095 2017-06 0.441211 2017-07 0.453947 2017-08 0.464805 ... 2021-02 0.007622 2021-03 0.000775 2021-04 0.002308 2021-05 0.022543 2021-06 -0.006534 2021-07 -0.012192 Freq: M, Name: portfolio_8378.PF, dtype: float64

>>> import matplotlib.pyplot as plt >>> pf.skewness_rolling(window=12*10).plot() >>> plt.show()

- property kurtosis

Calculate expanding Fisher (normalized) kurtosis time series for portfolio rate of return.

Kurtosis is a measure of whether the rate of return are heavy-tailed or light-tailed relative to a normal distribution. It should be close to zero for normally distributed rate of return. Kurtosis is the fourth central moment divided by the square of the variance.

- Returns:

- Series

Expanding kurtosis time series

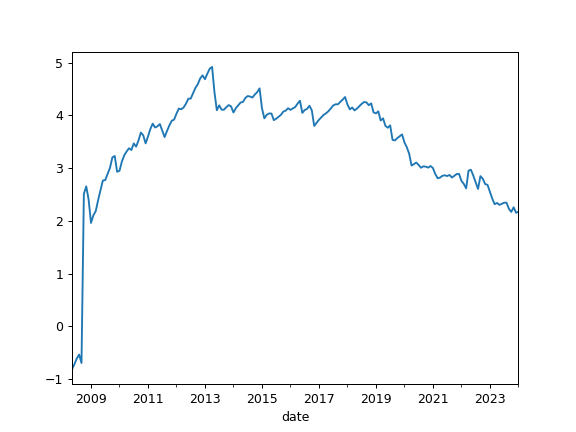

Examples

>>> pf = ok.Portfolio(['BND.US']) >>> pf.kurtosis Date 2008-05 -0.815206 2008-06 -0.718330 2008-07 -0.610741 2008-08 -0.534105 ... 2021-04 2.821322 2021-05 2.855267 2021-06 2.864717 2021-07 2.850407 Freq: M, Name: portfolio_4411.PF, Length: 159, dtype: float64

>>> import matplotlib.pyplot as plt >>> pf.kurtosis.plot() >>> plt.show()

- kurtosis_rolling(window=60)

Calculate rolling Fisher (normalized) kurtosis time series for portfolio rate of return.

Kurtosis is a measure of whether the rate of return are heavy-tailed or light-tailed relative to a normal distribution. It should be close to zero for normally distributed rate of return. Kurtosis is the fourth central moment divided by the square of the variance.

- Parameters:

- windowint, default 60

Size of the moving window in months. The window size should be at least 12 months.

- Returns:

- Series

Expanding kurtosis time series.

Examples

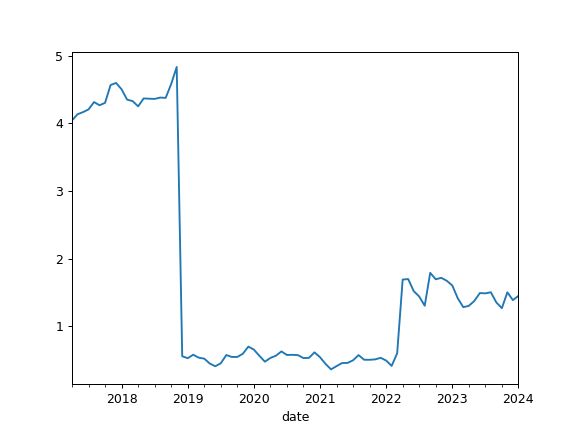

>>> pf = ok.Portfolio(['BND.US']) >>> pf.kurtosis_rolling(window=12*10) Date 2017-04 4.041599 2017-05 4.133518 2017-06 4.165099 2017-07 4.205125 2017-08 4.313773 ... 2021-03 0.362184 2021-04 0.409680 2021-05 0.455760 2021-06 0.457315 2021-07 0.496168 Freq: M, Name: portfolio_4411.PF, dtype: float64

>>> import matplotlib.pyplot as plt >>> pf.kurtosis_rolling(window=12*10).plot() >>> plt.show()

- property jarque_bera

Perform Jarque-Bera test for normality of portfolio returns time series.

Jarque-Bera shows whether the returns have the skewness and kurtosis matching a normal distribution (null hypothesis or H0).

- Returns:

- dict

Jarque-Bera test statistics and p-value.

Notes

Test returns statistics (first row) and p-value (second row). p-value is the probability of obtaining test results, under the assumption that the null hypothesis is correct. In general, a large Jarque-Bera statistics and tiny p-value indicate that null hypothesis is rejected and the time series are not normally distributed.

Examples

>>> pf = ok.Portfolio(['BND.US']) >>> pf.jarque_bera {'statistic': 58.27670538027455, 'p-value': 2.2148949341271873e-13}

- kstest(distr='norm')

Perform one sample Kolmogorov-Smirnov test on portfolio returns and evaluate goodness of fit for a given distribution.

The one-sample Kolmogorov-Smirnov test compares the rate of return time series against a given distribution.

- Parameters:

- distr{‘norm’, ‘lognorm’}, default ‘norm’

The name of a distribution to fit. ‘norm’ - for normal distribution. ‘lognorm’ - for lognormal distribution.

- Returns:

- dict

Kolmogorov-Smirnov test statistics and p-value.

Notes

Like in Jarque-Bera test returns statistic (first row) and p-value (second row). Null hypotesis (two distributions are similar) is not rejected when p-value is high enough. 5% threshold can be used.

Examples

>>> pf = ok.Portfolio(['GLD.US']) >>> pf.kstest(distr='lognorm') {'statistic': 0.05001344986084533, 'p-value': 0.6799422889377373}

>>> pf.kstest(distr='norm') {'statistic': 0.09528000069992831, 'p-value': 0.047761781235967415}

Kolmogorov-Smirnov test shows that GLD rate of return time series fits lognormal distribution better than normal one.

- get_sharpe_ratio(rf_return=0)

Calculate Sharpe ratio.

The Sharpe ratio is the average annual return in excess of the risk-free rate per unit of risk (annualized standard deviation).

Risk-free rate should be taken according to the Portfolio base currency.

- Parameters:

- rf_returnfloat, default 0

Risk-free rate of return.

- Returns:

- float

Examples

>>> pf = ok.Portfolio(['VOO.US', 'BND.US'], weights=[0.40, 0.60]) >>> pf.get_sharpe_ratio(rf_return=0.04) 0.7412193684695373

- get_sortino_ratio(t_return=0)

Calculate Sortino ratio for the portfolio with specified target return.

Sortion ratio measures the risk-adjusted return of portfolio. It is a modification of the Sharpe ratio but penalizes only those returns falling below a specified target rate of return, while the Sharpe ratio penalizes both upside and downside volatility equally.

- Parameters:

- t_returnfloat, default 0

Traget rate of return.

- Returns:

- float

Examples

>>> pf = ok.Portfolio(['VOO.US', 'BND.US'], last_date='2021-12') >>> pf.get_sortino_ratio(t_return=0.02) 1.4377728903230174

- property diversification_ratio

Calculate Diversification Ratio for the portfolio.

The Diversification Ratio is the ratio of the weighted average of assets risks divided by the portfolio risk. In this case risk is the annuilized standatd deviation for the rate of return .

- Returns:

- float

Examples

>>> pf = ok.Portfolio(['VOO.US', 'BND.US'], weights=[0.7, 0.3], last_date='2021-12') >>> pf.diversification_ratio 1.1264305597257505

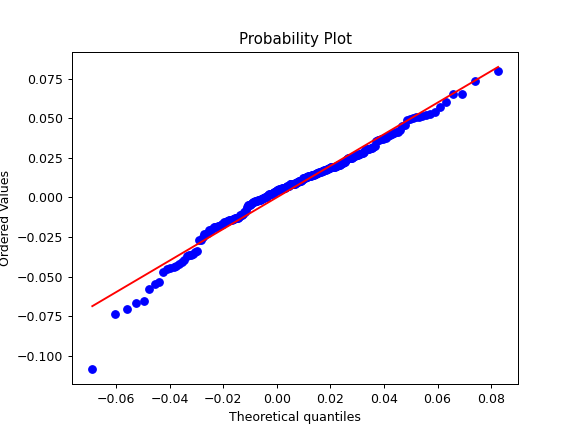

- plot_percentiles_fit(distr='norm', figsize=None)

Generate a quantile-quantile (Q-Q) plot of portfolio monthly rate of return against quantiles of a given theoretical distribution.

A q-q plot is a plot of the quantiles of the portfolio rate of return historical data against the quantiles of a given theoretical distribution.

- Parameters:

- distr{‘norm’, ‘lognorm’}, default ‘norm’

The name of a distribution to fit. ‘norm’ - for normal distribution. ‘lognorm’ - for lognormal distribution.

- figsize(float, float), optional

Width and height of plot in inches. If None default matplotlib figsize value is used.

Examples

>>> import matplotlib.pyplot as plt >>> pf = ok.Portfolio(['SPY.US', 'AGG.US', 'GLD.US'], weights=[.60, .35, .05], rebalancing_period='year') >>> pf.plot_percentiles_fit(distr='lognorm') >>> plt.show()

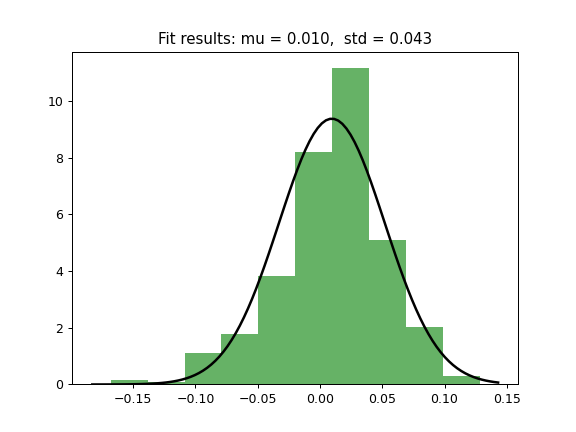

- plot_hist_fit(distr='norm', bins=None)

Plot historical distribution histogram for ptrtfolio monthly rate of return time series and theoretical PDF (Probability Distribution Function).

Examples

>>> import matplotlib.pyplot as plt >>> pf = ok.Portfolio(['SP500TR.INDX']) >>> pf.plot_hist_fit(distr='norm') >>> plt.show()

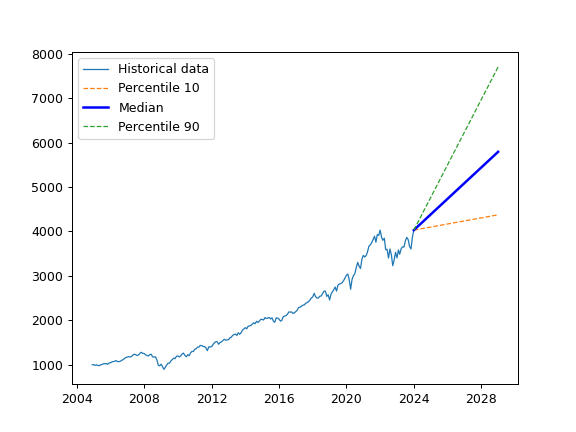

- plot_forecast(distr='norm', years=5, percentiles=[10, 50, 90], today_value=None, n=1000, figsize=None)

Plot forecasted ranges of wealth indexes (lines) for a given set of percentiles. Historical wealth index is shown in the same chart.

- Parameters:

- distr{‘hist’, ‘norm’, ‘lognorm’}, default ‘norm’

Distribution type for the rate of return of portfolio. ‘norm’ - for normal distribution. ‘lognorm’ - for lognormal distribution. ‘hist’ - percentiles are taken from the historical data.

- yearsint, default 1

Investment period length to calculate wealth index. It should not exceed 1/2 of the portfolio history period length ‘period_length’.

- percentileslist of int, default [10, 50, 90]

List of percentiles to be calculated.

- today_valueint, optional

Initial value of the wealth index. If today_value is None the last value of the historical wealth indexes is taken. It can be useful to plot the forecast of wealth index togeather with the hitorical data.

- nint, default 1000

Number of random time series to generate with Monte Carlo simulation (for ‘norm’ or ‘lognorm’ only). Larger argument values can be used to increase the precision of the calculation. But this will lead to slower performance. Is not required for historical distribution (dist=’hist’).

- Returns:

- Axes‘matplotlib.axes._subplots.AxesSubplot’

Examples

>>> import matplotlib.pyplot as plt >>> pf = ok.Portfolio(['SPY.US', 'AGG.US', 'GLD.US'], weights=[.60, .35, .05], rebalancing_period='year') >>> pf.plot_forecast() >>> plt.show()

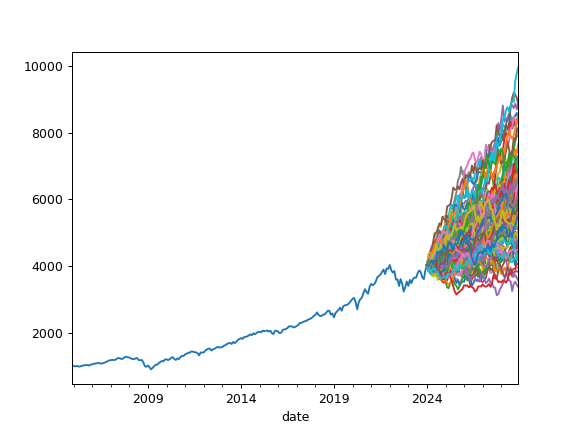

- plot_forecast_monte_carlo(distr='norm', years=1, n=20, figsize=None)

Plot Monte Carlo simulation for portfolio wealth indexes together with historical wealth index.

Random wealth indexes are generated according to a given distribution.

- Parameters:

- distr{‘norm’, ‘lognorm’}, default ‘norm’

Distribution type for the rate of return of portfolio. ‘norm’ - for normal distribution. ‘lognorm’ - for lognormal distribution.

- yearsint, default 1

Investment period length for new wealth indexes It should not exceed 1/2 of the portfolio history period length ‘period_length’.

- nint, default 20

Number of random wealth indexes to generate with Monte Carlo simulation.

- figsize(float, float), optional

Width, height in inches. If None default matplotlib figsize value is used.

Examples

>>> import matplotlib.pyplot as plt >>> pf = ok.Portfolio(['SPY.US', 'AGG.US', 'GLD.US'], ... weights=[.60, .35, .05], ... rebalancing_period='year') >>> pf.plot_forecast_monte_carlo(years=5, distr='lognorm', n=100) >>> plt.show()

- property currency

Return the base currency of the Asset List.

Such properties as rate of return and risk are adjusted to the base currency.

- Returns:

- okama.Asset

Base currency of the Asset List in form of okama.Asset class.

- plot_assets(kind='mean', tickers='tickers', pct_values=False, xy_text=(0, 10))

Plot the assets points on the risk-return chart with annotations.

Annualized values for risk and return are used. Risk is a standard deviation of monthly rate of return time series. Return can be an annualized mean return (expected return) or CAGR (Compound annual growth rate).

- Parameters:

- kind{‘mean’, ‘cagr’}, default ‘mean’

Type of Return: annualized mean return (expected return) or CAGR (Compound annual growth rate).

- tickers{‘tickers’, ‘names’} or list of str, default ‘tickers’

Annotation type for assets. ‘tickers’ - assets symbols are shown in form of ‘SPY.US’ ‘names’ - assets names are used like - ‘SPDR S&P 500 ETF Trust’ To show custom annotations for each asset pass the list of names.

- pct_valuesbool, default False

Risk and return values in the axes: Algebraic annotation (False) Percents (True)

- xy_texttuple, default (0, 10)

The shift of the annotation text (x, y) from the point.

- Returns:

- Axes‘matplotlib.axes._subplots.AxesSubplot’

Examples

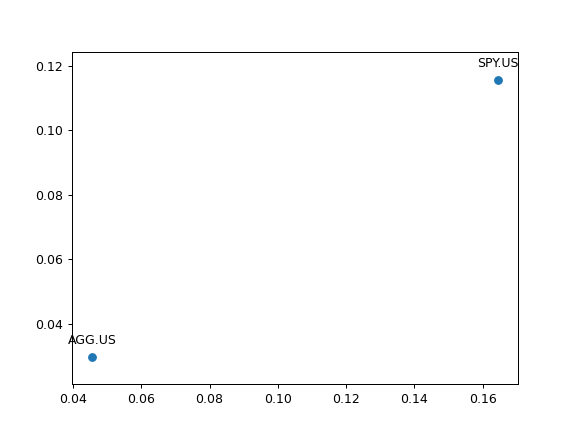

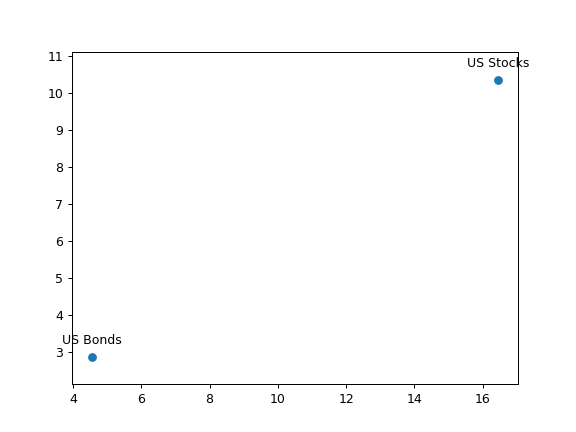

>>> import matplotlib.pyplot as plt >>> al = ok.AssetList(['SPY.US', 'AGG.US'], ccy='USD', inflation=False) >>> al.plot_assets() >>> plt.show()

Plotting with default parameters values shows expected return, ticker annotations and algebraic values for risk and return. To use CAGR instead of expected return use kind=’cagr’.

>>> al.plot_assets(kind='cagr', ... tickers=['US Stocks', 'US Bonds'], # use custom annotations for the assets ... pct_values=True # risk and return values are in percents ... ) >>> plt.show()

- property symbols

Return a list of financial symbols used to set the AssetList.

Symbols are similar to tickers but have a namespace information:

SPY.US is a symbol

SPY is a ticker

- Returns:

- list of str

List of symbols included in the Asset List.

- property tickers

Return a list of tickers (symbols without a namespace) used to set the AssetList.

tickers are similar to symbols but do not have namespace information:

SPY is a ticker

SPY.US is a symbol

- Returns:

- list of str

List of tickers included in the Asset List.