okama.Asset

- class Asset(symbol='SPY.US')

Bases:

objectA financial asset, that could be used in a list of assets or in portfolio.

- Parameters:

- symbol: str, default “SPY.US”

Symbol is an asset ticker with namespace after dot. The default value is “SPY.US” (SPDR S&P 500 ETF Trust).

Methods & Attributes

Return adjusted close price time series historical daily data.

Return close price time series historical daily data.

Return close price time series historical monthly data.

Return dividends time series historical monthly data.

Return NAV time series (monthly) for mutual funds.

Return live price of an asset.

Return a symbol of the asset.

- property symbol

Return a symbol of the asset.

- Returns:

- str

- property price

Return live price of an asset.

Live price is delayed (15-20 minutes). For certain namespaces (FX, INDX, PIF etc.) live price is not supported.

- Returns:

- float, None

Live price of the asset. Returns None if not defined.

- property close_daily

Return close price time series historical daily data.

- Returns:

- Series

Time series of close price historical data (daily).

- property close_monthly

Return close price time series historical monthly data.

Monthly close time series not adjusted to for corporate actions: dividends and splits.

- Returns:

- Series

Time series of close price historical data (monthly).

Examples

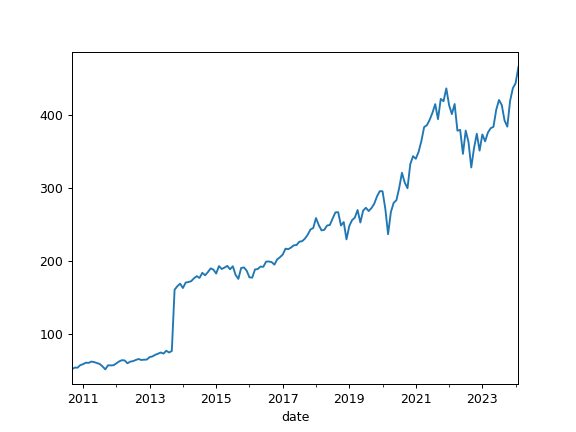

>>> import matplotlib.pyplot as plt >>> x = ok.Asset('VOO.US') >>> x.close_monthly.plot() >>> plt.show()

- property adj_close

Return adjusted close price time series historical daily data.

The adjusted closing price amends a stock’s closing price after accounting for corporate actions: dividends and splits. All values are adjusted by reducing the price prior to the dividend payment (or split).

- Returns:

- Series

Time series of adjusted close price historical data (daily).

- property dividends

Return dividends time series historical monthly data.

- Returns:

- Series

Time series of dividends historical data (monthly).

Examples

>>> x = ok.Asset('VNQ.US') >>> x.dividends Date 2004-12-22 1.2700 2005-03-24 0.6140 2005-06-27 0.6440 2005-09-26 0.6760 ... 2020-06-25 0.7590 2020-09-25 0.5900 2020-12-24 1.3380 2021-03-25 0.5264 Freq: D, Name: VNQ.US, Length: 66, dtype: float64

Return NAV time series (monthly) for mutual funds.