okama.AssetList.get_rolling_risk_annual

- AssetList.get_rolling_risk_annual(window=12)

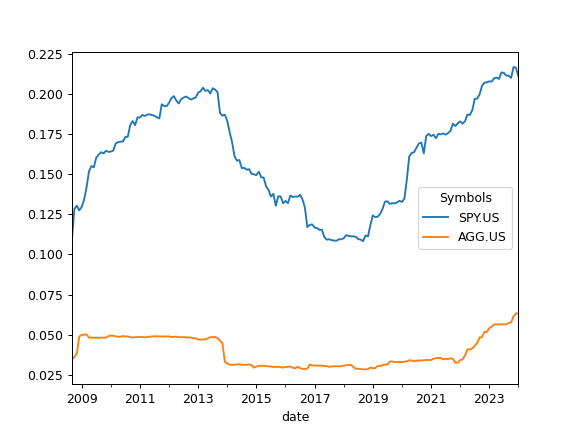

Calculate annualized risk rolling time series for each asset.

Risk is a standard deviation of the rate of return.

Annualized risk time series is calculated for the rate of return values limited by moving window.

- Parameters:

- windowint, default 12

Size of the moving window in months.

- Returns:

- DataFrame

Annualized risk (standard deviation) rolling time series for each asset.

See also

risk_monthlyCalculate montly risk expanding time series for each asset.

risk_annualCalculate annualized risks.

semideviation_monthlyCalculate semideviation monthly values.

semideviation_annualCalculate semideviation annualized values.

get_var_historicCalculate historic Value at Risk (VaR).

get_cvar_historicCalculate historic Conditional Value at Risk (CVaR).

drawdownsCalculate assets drawdowns.

Examples

>>> import matplotlib.pyplot as plt >>> x = ok.AssetList(['SPY.US', 'AGG.US'], ccy='USD', inflation=True) >>> x.get_rolling_risk_annual(window=5*12).plot() >>> plt.show()