You can run the code examples in Google Colab.

To install the package:

[ ]:

!pip install okama

import okama and matplotlib packages …

[2]:

import matplotlib.pyplot as plt

plt.rcParams["figure.figsize"] = [12.0, 6.0]

import okama as ok

AssetList has a set of methods usefull to track perfomance of index funds and compare them with benchmarks: - tracking difference - tracking error - beta - rolling and cumulative correlations

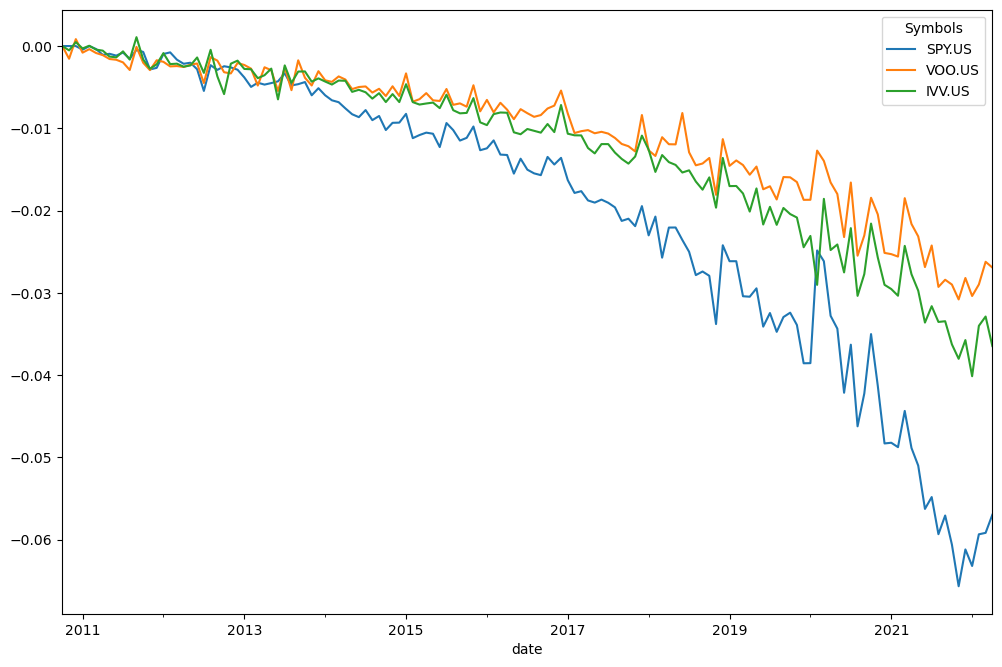

Tracking difference

Tracking diffrenece is calculated by measuring the difference between the accumulated return of an index and those of the ETFs replicating it.

Let’s compare main S&P500 ETFs.

[3]:

symbols = [

"SP500TR.INDX",

"SPY.US",

"VOO.US",

"IVV.US",

] # the benchmark symbol should be in the first place

sp = ok.AssetList(symbols, last_date="2022-04")

sp

[3]:

assets [SP500TR.INDX, SPY.US, VOO.US, IVV.US]

currency USD

first_date 2010-10

last_date 2022-04

period_length 11 years, 7 months

inflation USD.INFL

dtype: object

[4]:

sp.names

[4]:

{'SP500TR.INDX': 'S&P 500 TR (Total Return)',

'SPY.US': 'SPDR S&P 500 ETF Trust',

'VOO.US': 'Vanguard S&P 500 ETF',

'IVV.US': 'iShares Core S&P 500 ETF'}

We can check the general tracking difference as a difference in their accumulated return.

[5]:

sp.tracking_difference().plot();

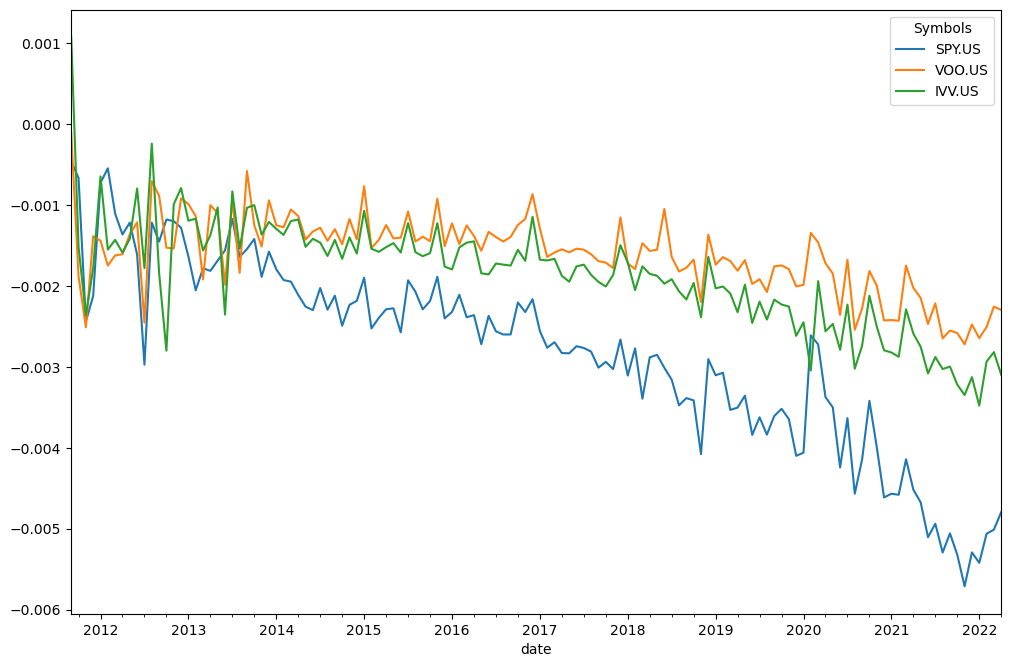

… or see annualized values.

[6]:

sp.tracking_difference_annualized().plot();

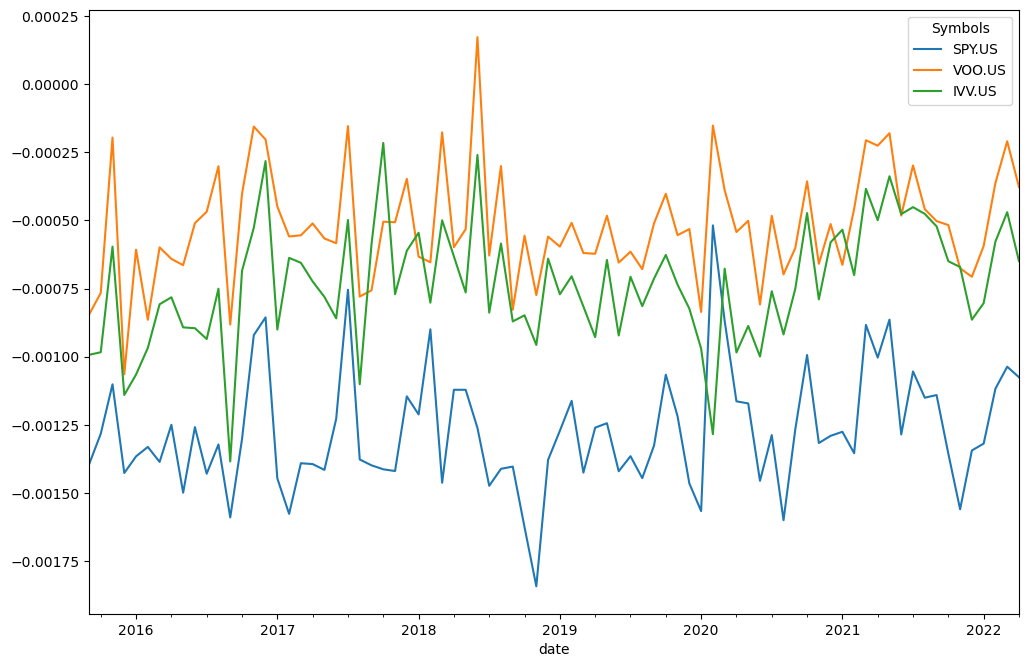

[7]:

sp.tracking_difference_annualized(rolling_window=5 * 12).plot() # rolling window is 5 years

[7]:

<AxesSubplot: xlabel='date'>

rolling_window parameter is also available in tracking_error(), index_beta() and index_correlation() functions.

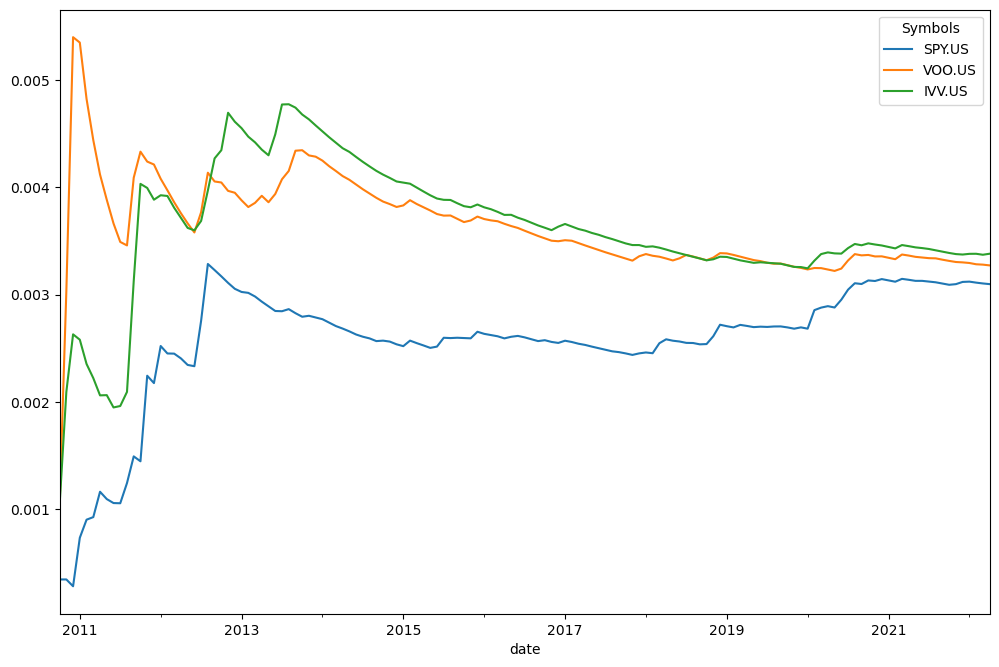

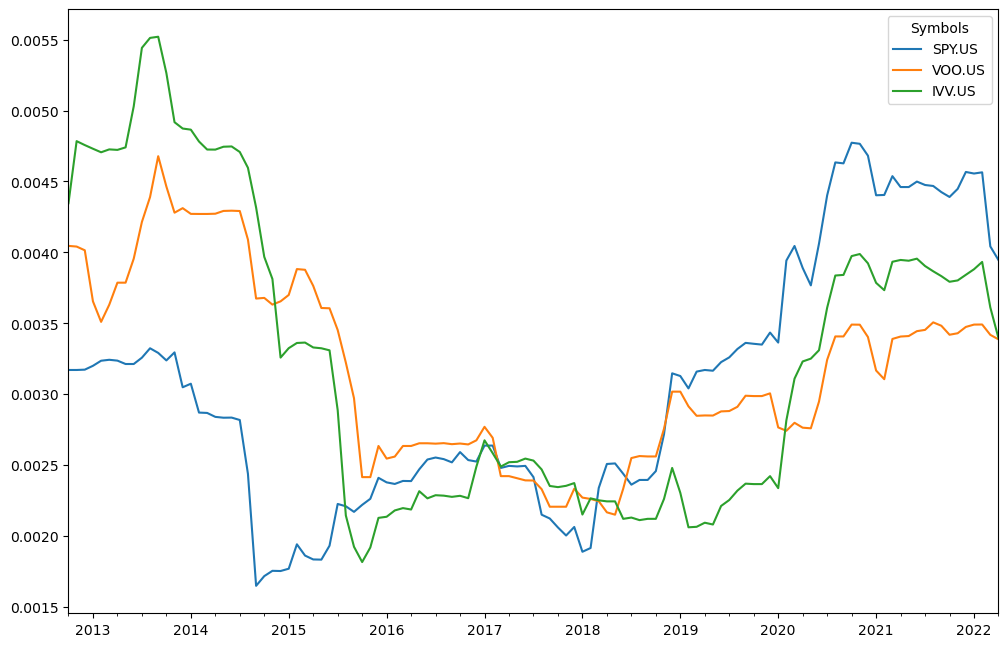

Tracking Error

Tracking Error is the standard deviation of the difference between the ETF and index returns.

[8]:

sp.tracking_error().plot();

… or rolling tracking error:

[9]:

sp.tracking_error(rolling_window=12 * 2).plot();

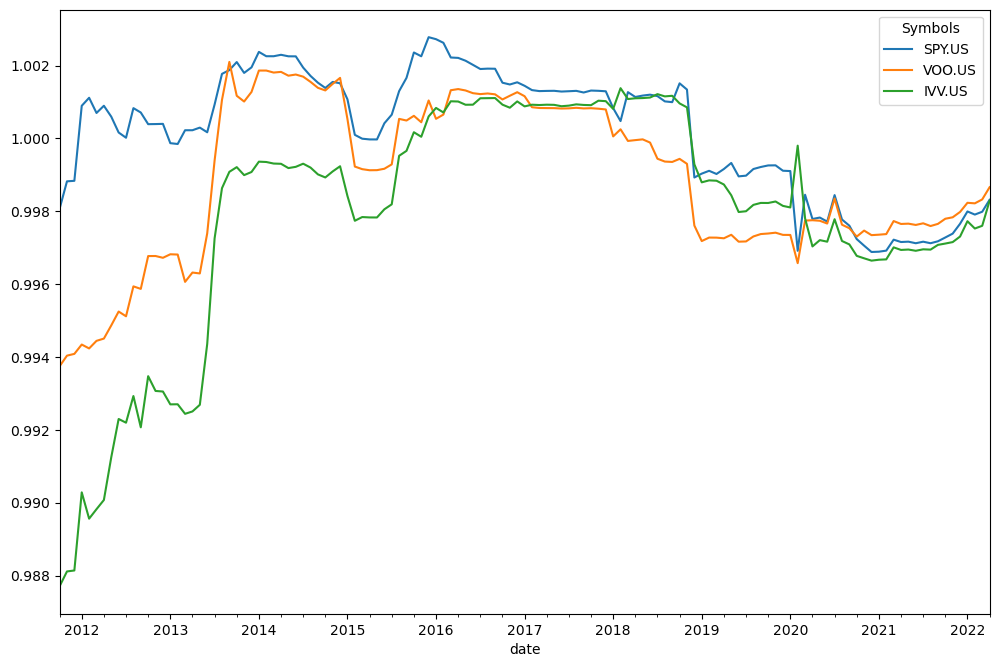

Beta

[10]:

sp.index_beta().plot(); # in this example as expected beta is close to 1. Each ETF represents broad market in form of S&P 500 index

… we see here that all 3 funds have similar beta.

Rolling beta is also available:

[12]:

sp.index_beta(rolling_window=12).plot();

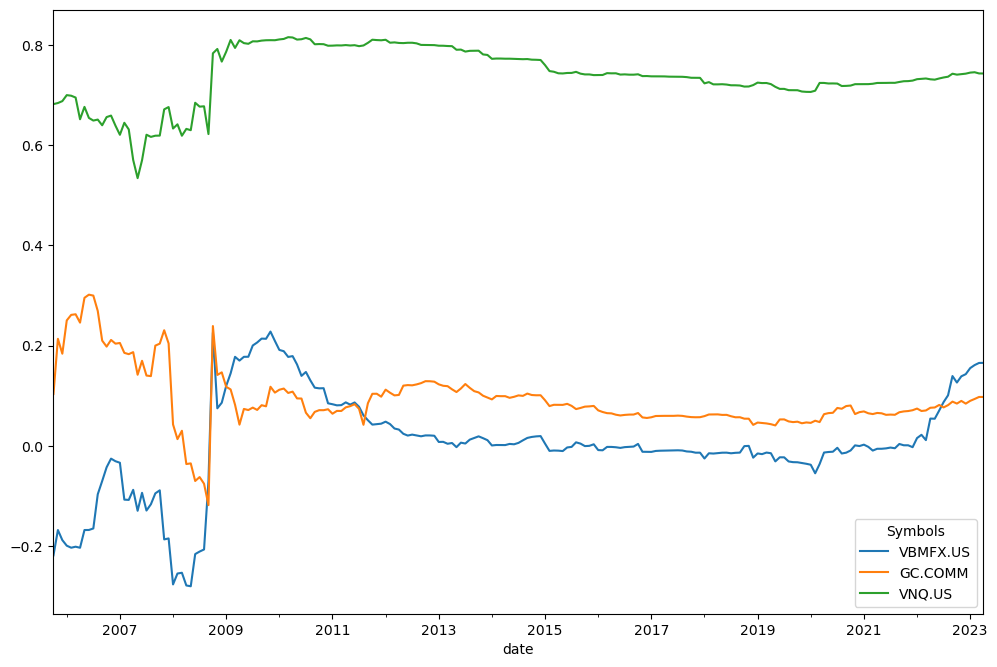

Correlation with index

Sometimes it’s useful to check the correlation between different asset types.

In this example we verify the correlation:

US stocks (S&P 500 index)

US bonds (Vanguard mutual fund)

gold (spot prices)

US Real Estate (REIT ETF)

[13]:

assets = ["SP500TR.INDX", "VBMFX.US", "GC.COMM", "VNQ.US"] # GC.COMM - gold spot prices

x = ok.AssetList(assets)

x

[13]:

assets [SP500TR.INDX, VBMFX.US, GC.COMM, VNQ.US]

currency USD

first_date 2004-10

last_date 2023-04

period_length 18 years, 7 months

inflation USD.INFL

dtype: object

[14]:

x.names

[14]:

{'SP500TR.INDX': 'S&P 500 TR (Total Return)',

'VBMFX.US': 'VANGUARD TOTAL BOND MARKET INDEX FUND INVESTOR SHARES',

'GC.COMM': 'Gold (COMEX)',

'VNQ.US': 'Vanguard Real Estate Index Fund ETF Shares'}

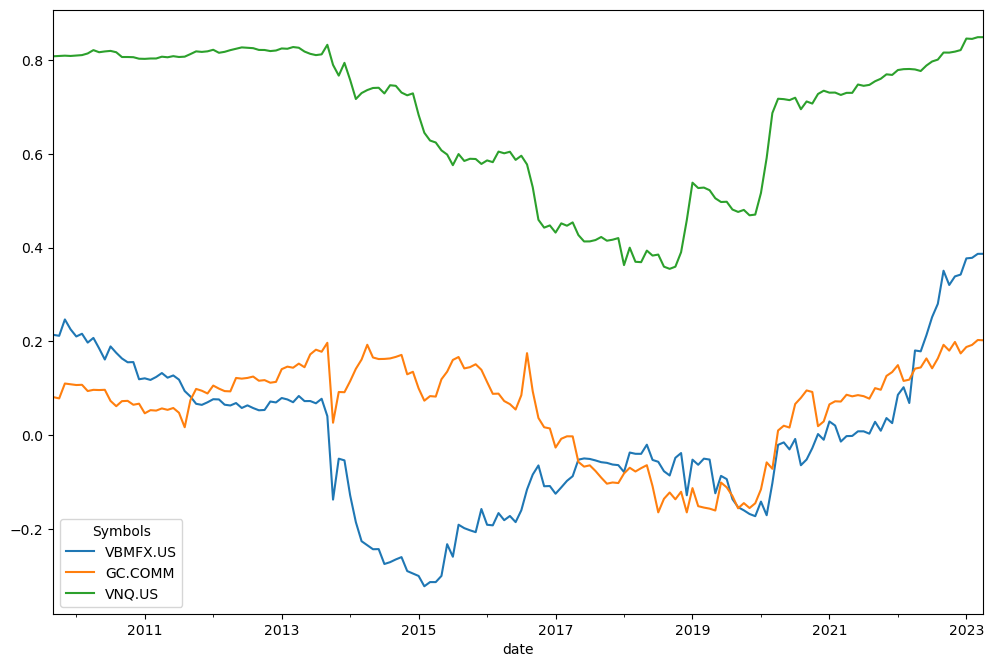

.index_corr() calculates expanding or rolling correlation with the benchmark.[15]:

x.index_corr().plot(); # expanding correlation rolling_window = None

[16]:

x.index_corr(rolling_window=12 * 5).plot(); # rolling window size is 5 years

It can be clearly seen that real estat ETF (VNQ) has higher correlation with stocks comparing with gold prices and bonds during this period.

[ ]: