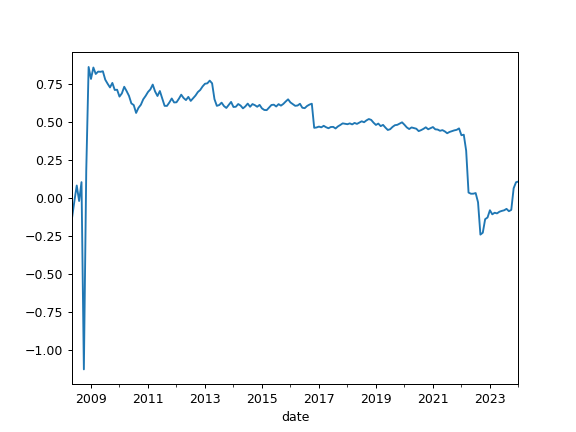

okama.Portfolio.skewness

- property Portfolio.skewness

Compute expanding skewness time series for portfolio rate of return.

For normally distributed data, the skewness should be about zero. A skewness value greater than zero means that there is more weight in the right tail of the distribution.

- Returns:

- Series

Expanding skewness time series

Examples

>>> pf = ok.Portfolio(['BND.US']) >>> pf.skewness Date 2008-05 -0.134193 2008-06 -0.022349 2008-07 0.081412 2008-08 -0.020978 ... 2021-04 0.441430 2021-05 0.445772 2021-06 0.437383 2021-07 0.425247 Freq: M, Name: portfolio_8378.PF, Length: 159, dtype: float64

>>> import matplotlib.pyplot as plt >>> pf.skewness.plot() >>> plt.show()