okama.Portfolio.plot_percentiles_fit

- Portfolio.plot_percentiles_fit(distr='norm', figsize=None)

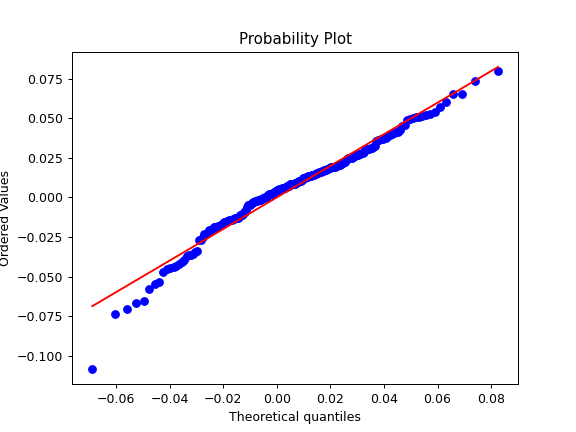

Generate a quantile-quantile (Q-Q) plot of portfolio monthly rate of return against quantiles of a given theoretical distribution.

A q-q plot is a plot of the quantiles of the portfolio rate of return historical data against the quantiles of a given theoretical distribution.

- Parameters:

- distr{‘norm’, ‘lognorm’}, default ‘norm’

The name of a distribution to fit. ‘norm’ - for normal distribution. ‘lognorm’ - for lognormal distribution.

- figsize(float, float), optional

Width and height of plot in inches. If None default matplotlib figsize value is used.

Examples

>>> import matplotlib.pyplot as plt >>> pf = ok.Portfolio(['SPY.US', 'AGG.US', 'GLD.US'], weights=[.60, .35, .05], rebalancing_period='year') >>> pf.plot_percentiles_fit(distr='lognorm') >>> plt.show()