okama.Portfolio.kurtosis

- property Portfolio.kurtosis

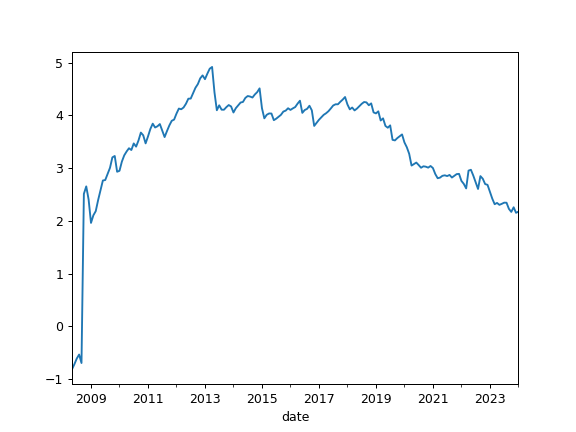

Calculate expanding Fisher (normalized) kurtosis time series for portfolio rate of return.

Kurtosis is a measure of whether the rate of return are heavy-tailed or light-tailed relative to a normal distribution. It should be close to zero for normally distributed rate of return. Kurtosis is the fourth central moment divided by the square of the variance.

- Returns:

- Series

Expanding kurtosis time series

Examples

>>> pf = ok.Portfolio(['BND.US']) >>> pf.kurtosis Date 2008-05 -0.815206 2008-06 -0.718330 2008-07 -0.610741 2008-08 -0.534105 ... 2021-04 2.821322 2021-05 2.855267 2021-06 2.864717 2021-07 2.850407 Freq: M, Name: portfolio_4411.PF, Length: 159, dtype: float64

>>> import matplotlib.pyplot as plt >>> pf.kurtosis.plot() >>> plt.show()