okama.EfficientFrontier.mdp_points

- property EfficientFrontier.mdp_points

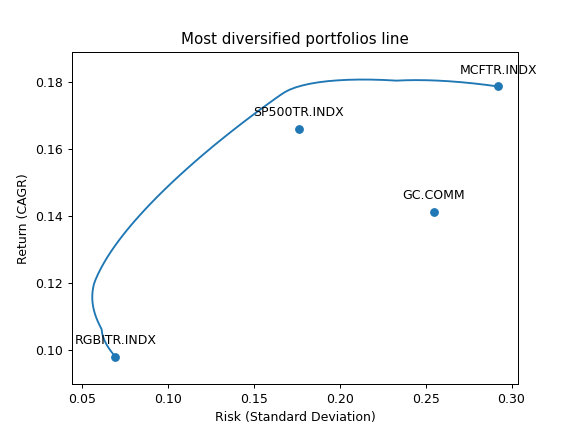

Generate Most diversified portfolios line.

Each point on the Most diversified portfolios line is a portfolio with optimized Diversification ratio for a given return.

The points are obtained through the constrained optimization process (optimization with bounds). Bounds are defined with ‘bounds’ property.

- Returns:

- DataFrame

Table of weights and risk/return values for the Efficient Frontier. The columns:

assets weights

CAGR (geometric mean)

Mean return (arithmetic mean)

Risk (standard deviation)

Diversification ratio

All the values are annualized.

Examples

>>> ls4 = ['SP500TR.INDX', 'MCFTR.INDX', 'RGBITR.INDX', 'GC.COMM'] >>> y = ok.EfficientFrontier(assets=ls4, ccy='RUB', last_date='2021-12', n_points=100) >>> y.mdp_points # print mdp weights, risk, mean return, CAGR and Diversification ratio Risk Mean return CAGR ... MCFTR.INDX RGBITR.INDX SP500TR.INDX 0 0.066040 0.094216 0.092220 ... 2.081668e-16 1.000000e+00 0.000000e+00 1 0.064299 0.095342 0.093451 ... 0.000000e+00 9.844942e-01 5.828671e-16 2 0.062761 0.096468 0.094670 ... 0.000000e+00 9.689885e-01 1.110223e-16 3 0.061445 0.097595 0.095874 ... 5.828671e-16 9.534827e-01 0.000000e+00 4 0.060364 0.098724 0.097065 ... 3.191891e-16 9.379769e-01 0.000000e+00 .. ... ... ... ... ... ... ... 95 0.258857 0.205984 0.178346 ... 8.840844e-01 1.387779e-17 0.000000e+00 96 0.266583 0.207214 0.177941 ... 9.130633e-01 3.469447e-18 0.000000e+00 97 0.274594 0.208446 0.177432 ... 9.420422e-01 0.000000e+00 1.075529e-16 98 0.282873 0.209678 0.176820 ... 9.710211e-01 2.428613e-17 6.938894e-18 99 0.291402 0.210912 0.176103 ... 1.000000e+00 2.775558e-16 3.951094e-09 [100 rows x 8 columns]

To plot the Most diversification portfolios line use the DataFrame with the points data. Additionaly ‘Plot.plot_assets()’ can be used to show the assets in the chart.

>>> import matplotlib.pyplot as plt >>> fig = plt.figure() >>> # Plot the assets points >>> y.plot_assets(kind='cagr') # kind should be set to "cagr" as we take "CAGR" column from the ef_points. >>> ax = plt.gca() >>> # Plot the Most diversified portfolios line >>> df = y.mdp_points >>> ax.plot(df['Risk'], df['CAGR']) # we chose to plot CAGR which is geometric mean of return series >>> # Set the axis labels and the title >>> ax.set_title('Most diversified portfolios line') >>> ax.set_xlabel('Risk (Standard Deviation)') >>> ax.set_ylabel('Return (CAGR)') >>> plt.show()