okama.EfficientFrontierReb.get_monte_carlo

- EfficientFrontierReb.get_monte_carlo(n=100)

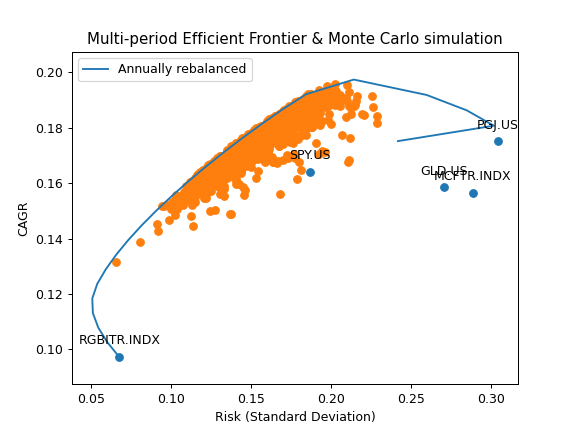

Generate N random rebalanced portfolios with Monte Carlo simulation.

Risk (annualized standard deviation) and Return (CAGR) are calculated for a set of random weights.

- Parameters:

- nint, default 100

Number of random portfolios to generate with Monte Carlo simulation.

- Returns:

- DataFrame

Table with Return (CAGR) and Risk values for random portfolios (portfolios with random asset weights).

Examples

>>> ls_m = ['SPY.US', 'GLD.US', 'PGJ.US', 'RGBITR.INDX', 'MCFTR.INDX'] >>> curr_rub = 'RUB' >>> x = ok.EfficientFrontierReb(assets=ls_m, ... first_date='2005-01', ... last_date='2020-11', ... ccy=curr_rub, ... rebalancing_period='year', # set rebalancing period to one year ... n_points=20, ... verbose=False) >>> monte_carlo = x.get_monte_carlo(n=1000) # it can take some time ... >>> monte_carlo.head(5) CAGR Risk 0 0.182937 0.178518 1 0.184915 0.172965 2 0.154892 0.141681 3 0.185500 0.168739 4 0.176748 0.192657

Monte Carlo simulation results can be plotted togeather with the optimized portfolios on the Efficient Frontier.

>>> import matplotlib.pyplot as plt >>> df_reb_year = x.ef_points # optimize portfolios for EF. Calculations will take some time ... >>> fig = plt.figure() >>> # Plot the assets points (optional). >>> x.plot_assets(kind='cagr') >>> ax = plt.gca() >>> # Plot random portfolios (Monte Carlo simulation) >>> ax.scatter(monte_carlo.Risk, monte_carlo.CAGR) >>> # Plot the Efficient Frontier >>> ax.plot(df_reb_year.Risk, df_reb_year.CAGR, label='Annually rebalanced') >>> # Set the axis labels and Title >>> ax.set_title('Multi-period Efficient Frontier & Monte Carlo simulation') >>> ax.set_xlabel('Risk (Standard Deviation)') >>> ax.set_ylabel('CAGR') >>> ax.legend() >>> plt.show()